Recommendation Tips About Common Size Income Statement Excel

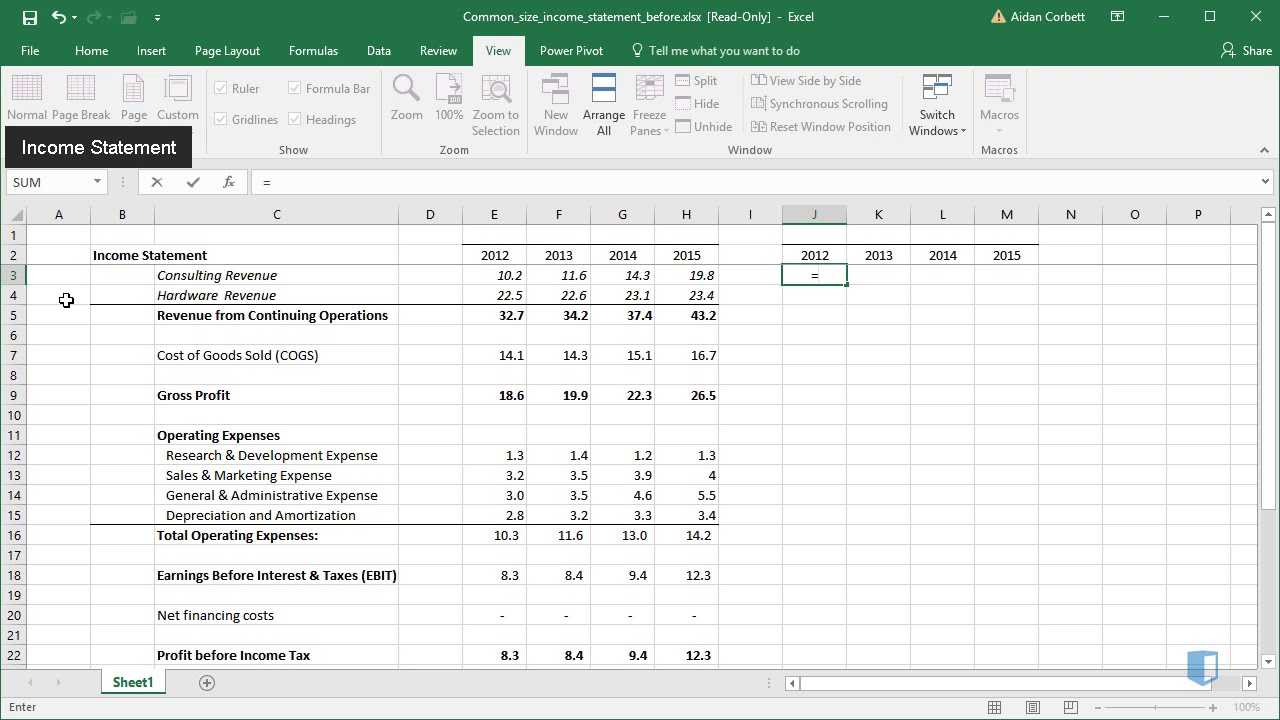

Launch excel and open the balance sheet with your financial statement figures.

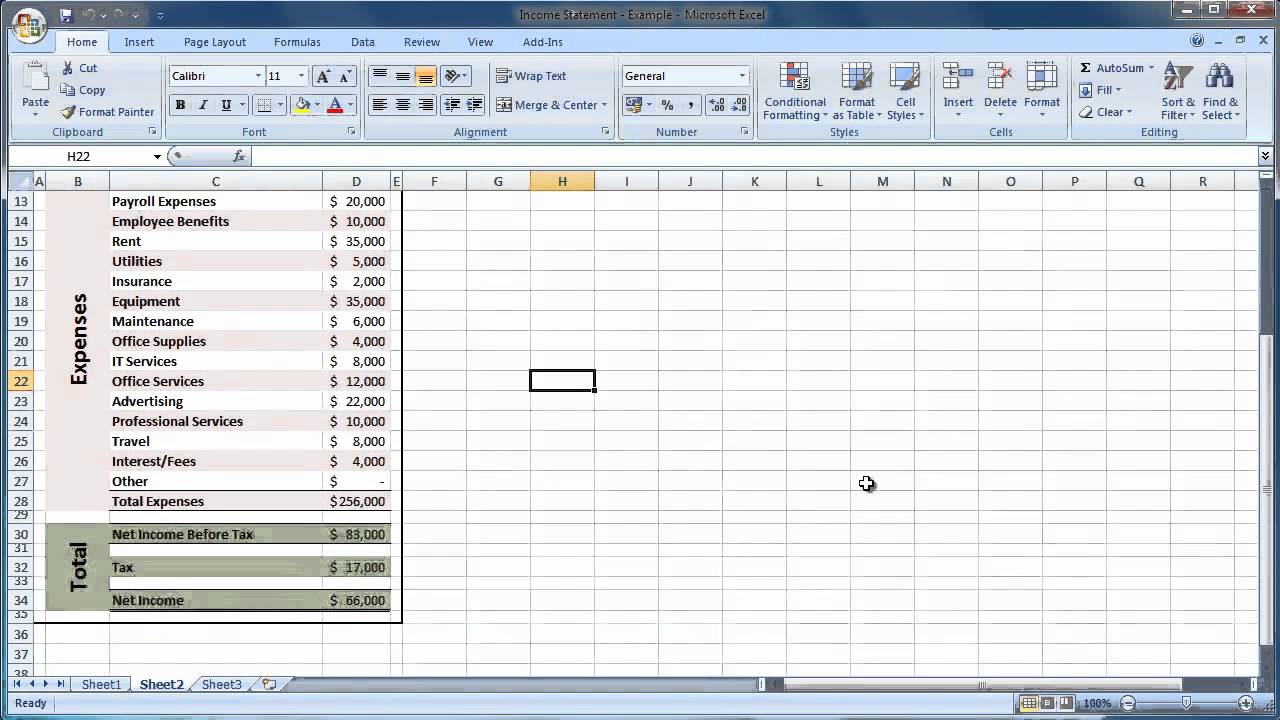

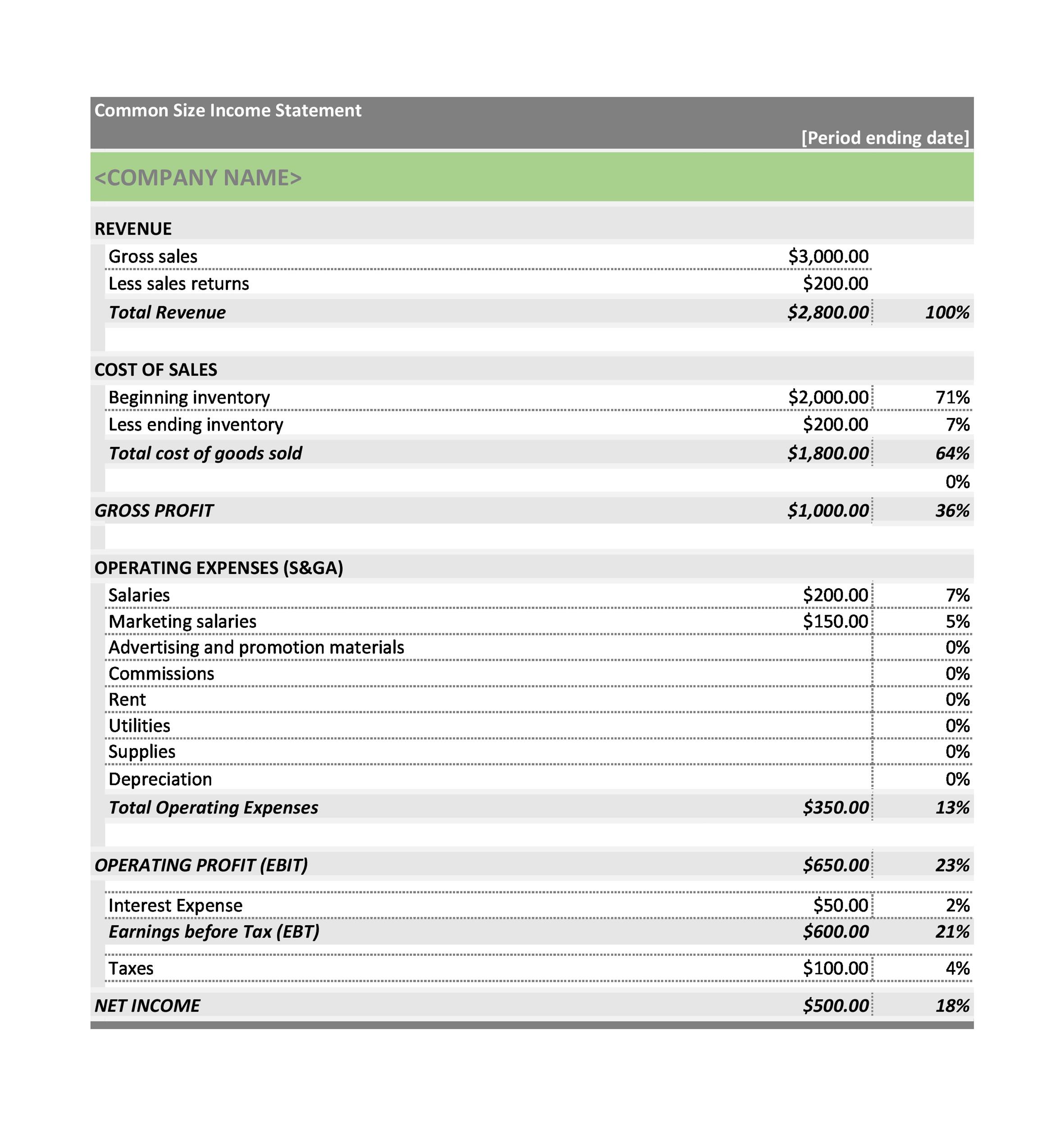

Common size income statement excel. What does it do? 5.0 annual fee $0 read review learn more common size analysis formula accounting software will typically run a common size financial analysis for you, but it's. The common size income statement divides all the entries on an income statement by total revenue, letting you see which costs are the largest.

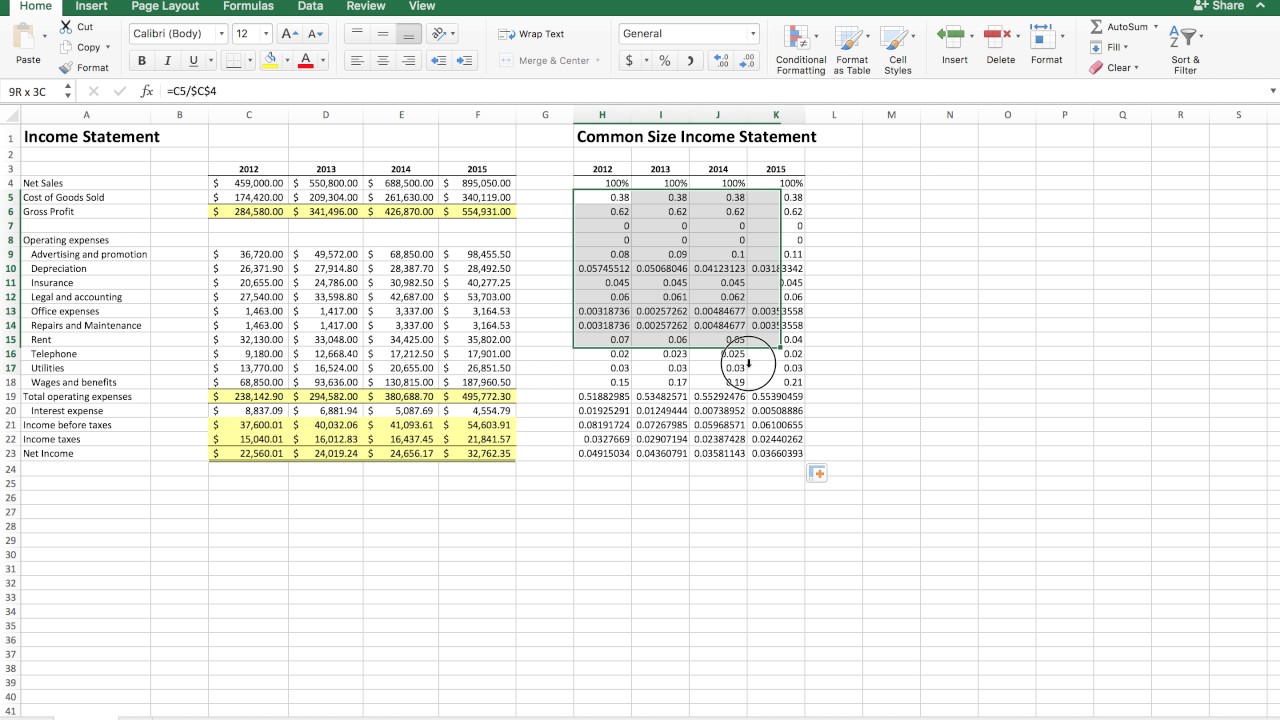

Details file format xls xlsx size: Common size analysis evaluates financial statements by expressing each line item as a percentage of a base amount for that period. It integrates excel functions and guides, suits online.

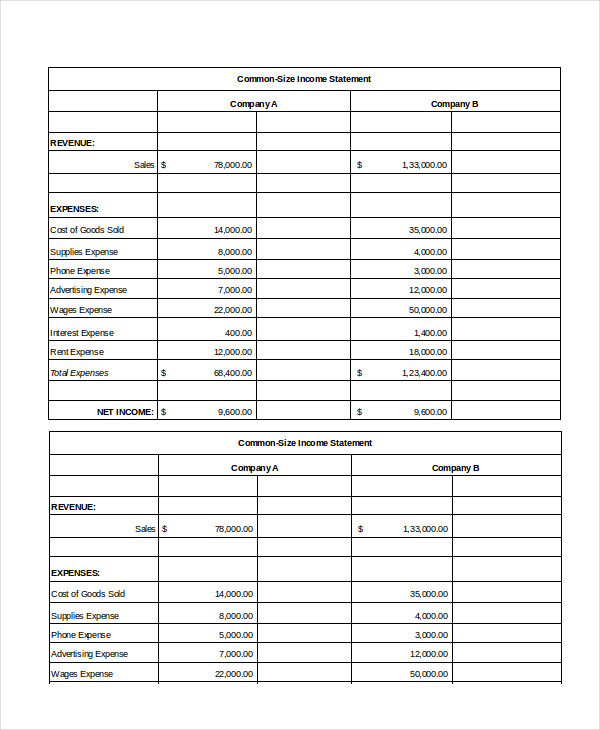

12 kb download now the sheet features a simple design which makes it easy to use. Expressing each item on the income statement as a percentage rather than in. In the balance sheet, the common.

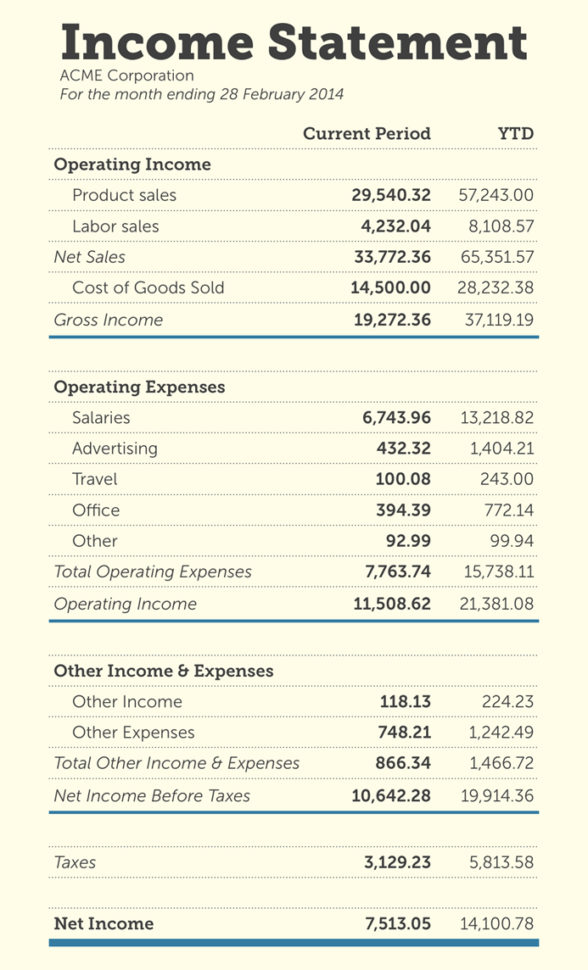

You can use it in financial analysis to compare the relative results of two or more. This is not a separate. 78k views 7 years ago financial modelling using excel.

The formula for common size analysis is. A common size income statement is one that has an additional column showing each monetary amount as a percentage of the revenue. Updated may 3, 2021 the practice of common sizing financial statements allows you to compare two companies that are of different sizes.

The common size income statement, is the profit and loss statement of the company where each line item is shown as a percentage of the total sales. Examples of common size income statement (with excel template) let’s take an example to understand the calculation in a better manner. Type the date for which you're calculating the accounts into cell “b1,” and enter “% terms” into cell “c1.”.

In cell “a2,” enter “net sales” if you're making a common. This type of analysis helps you see how revenue.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)