Here’s A Quick Way To Solve A Tips About Payroll Excel Sheet With Formula

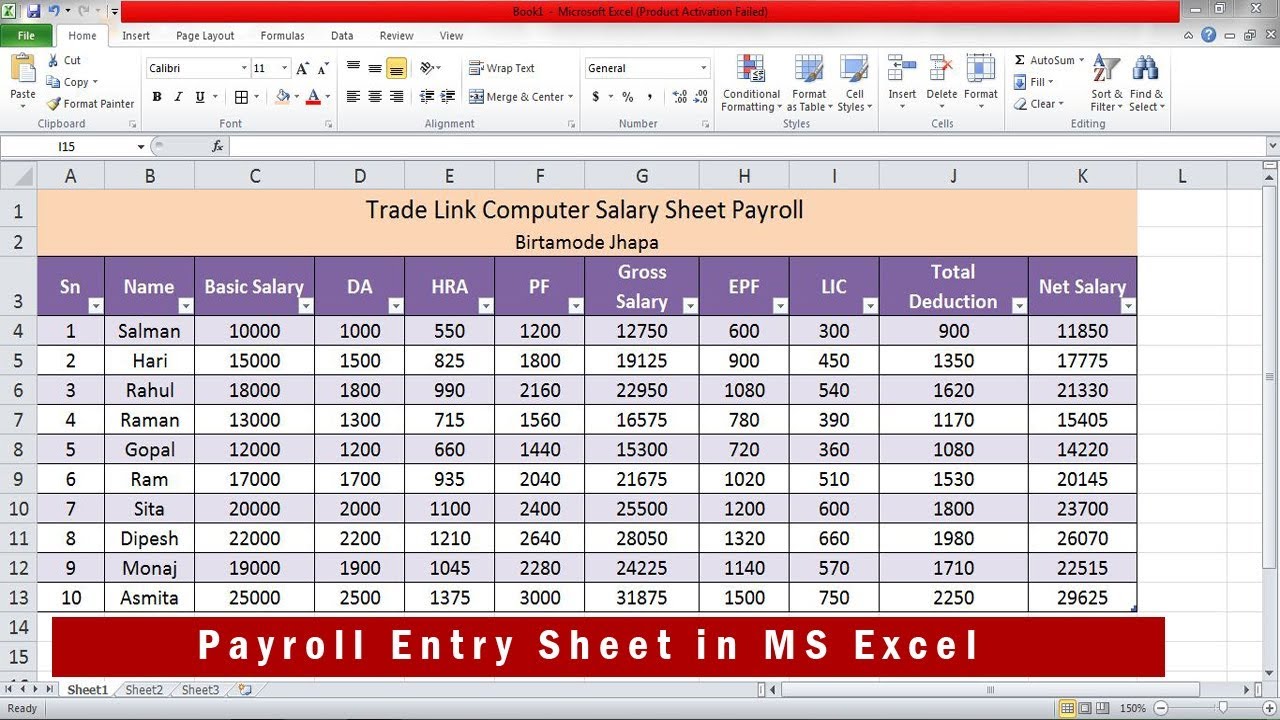

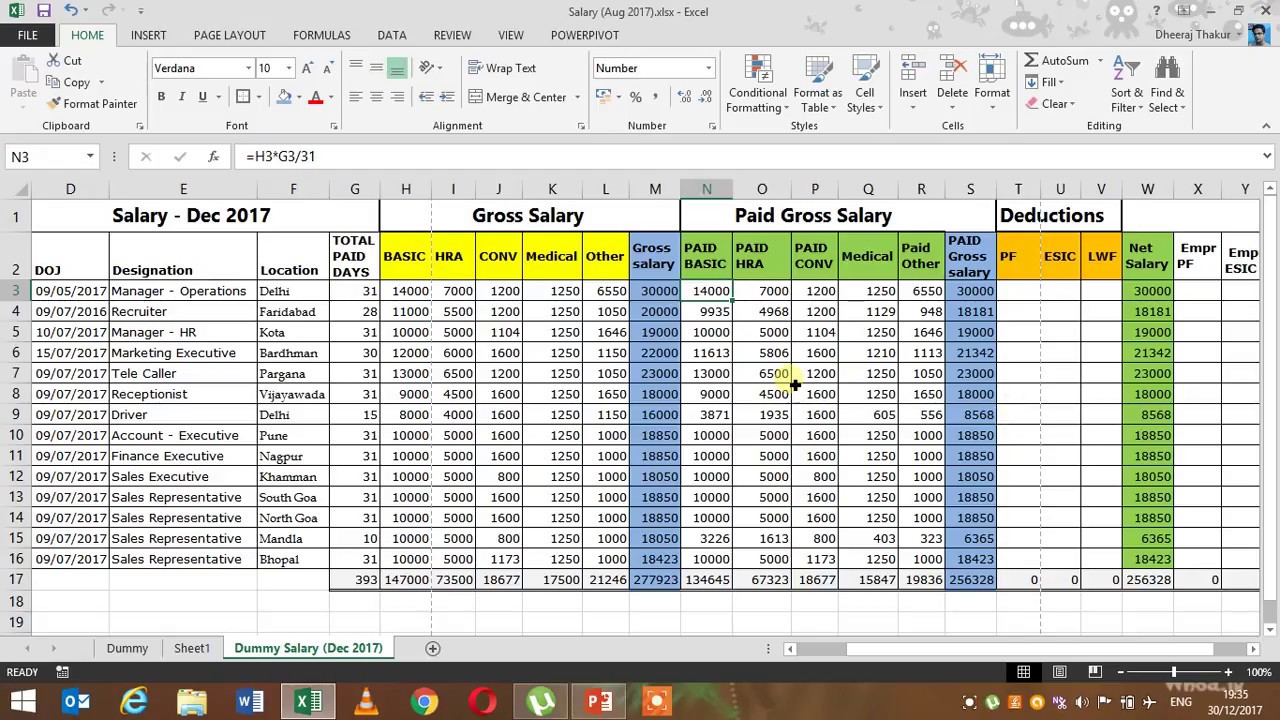

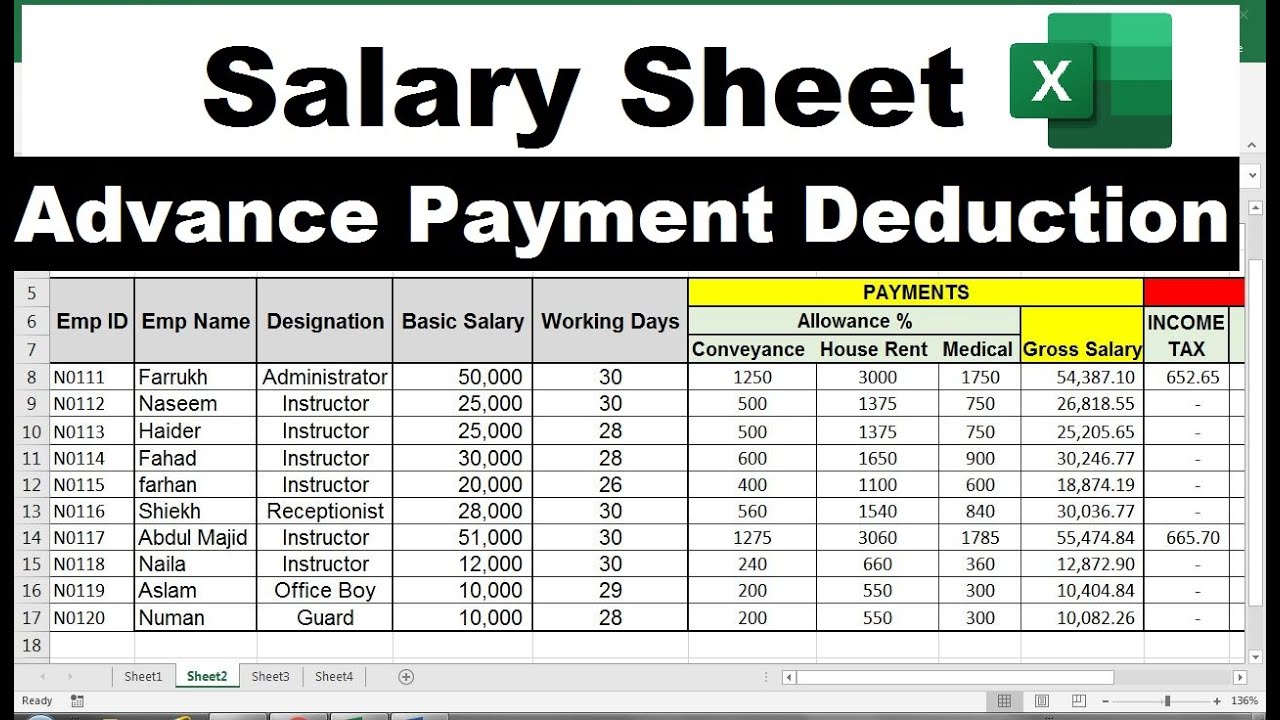

The template follows the rules of the indian salary structure.

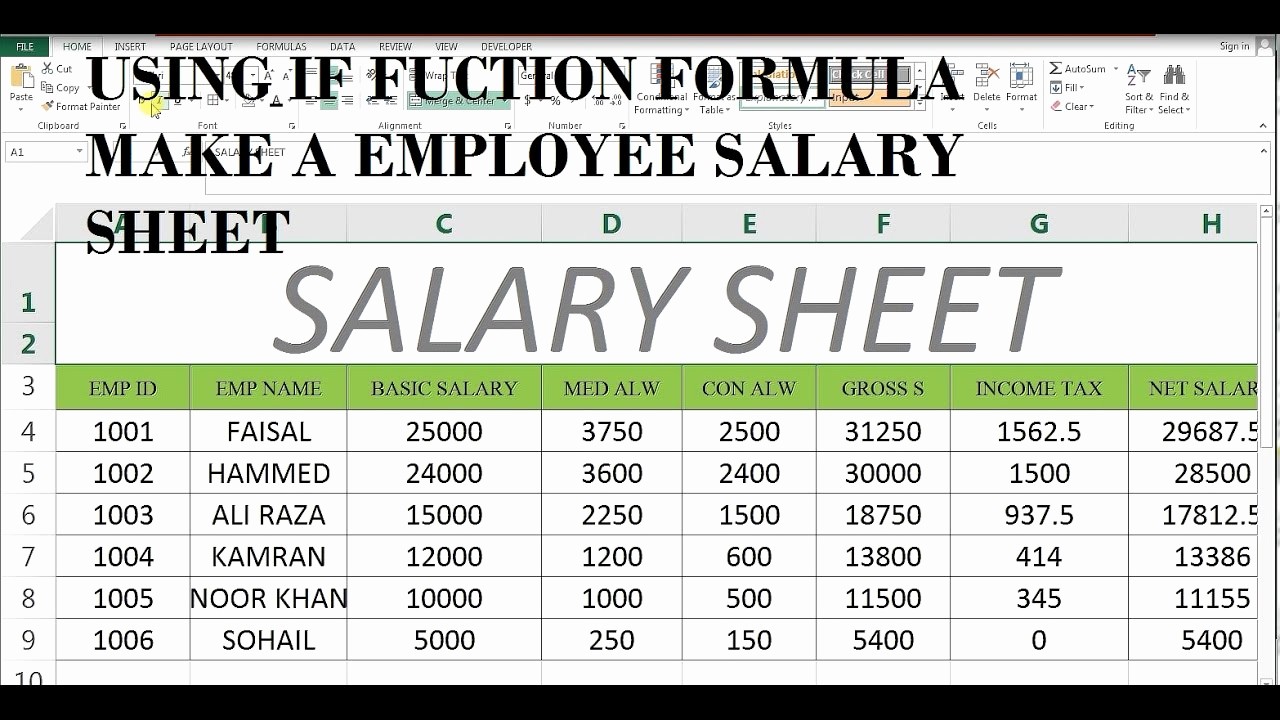

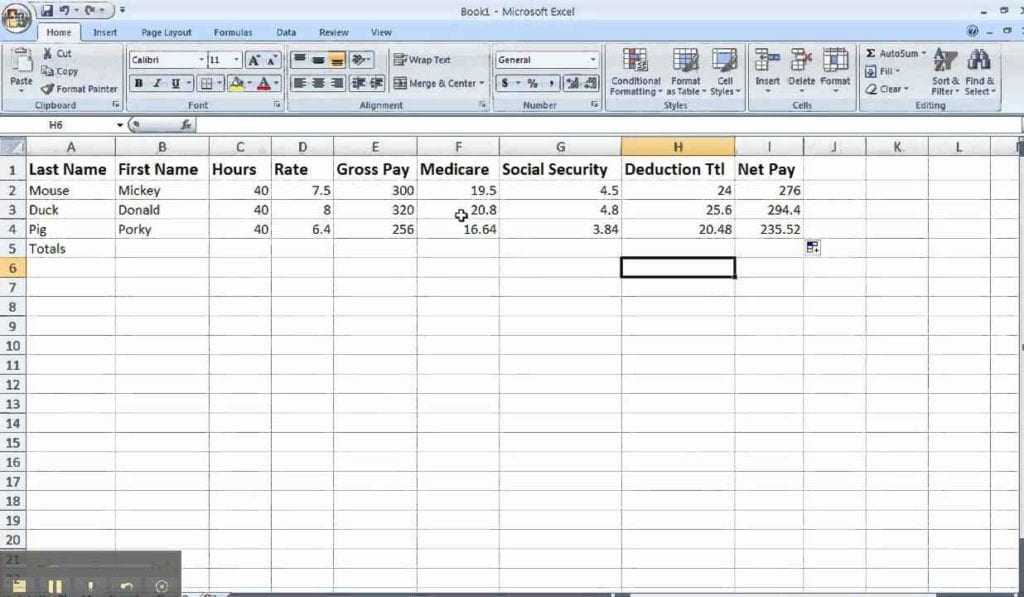

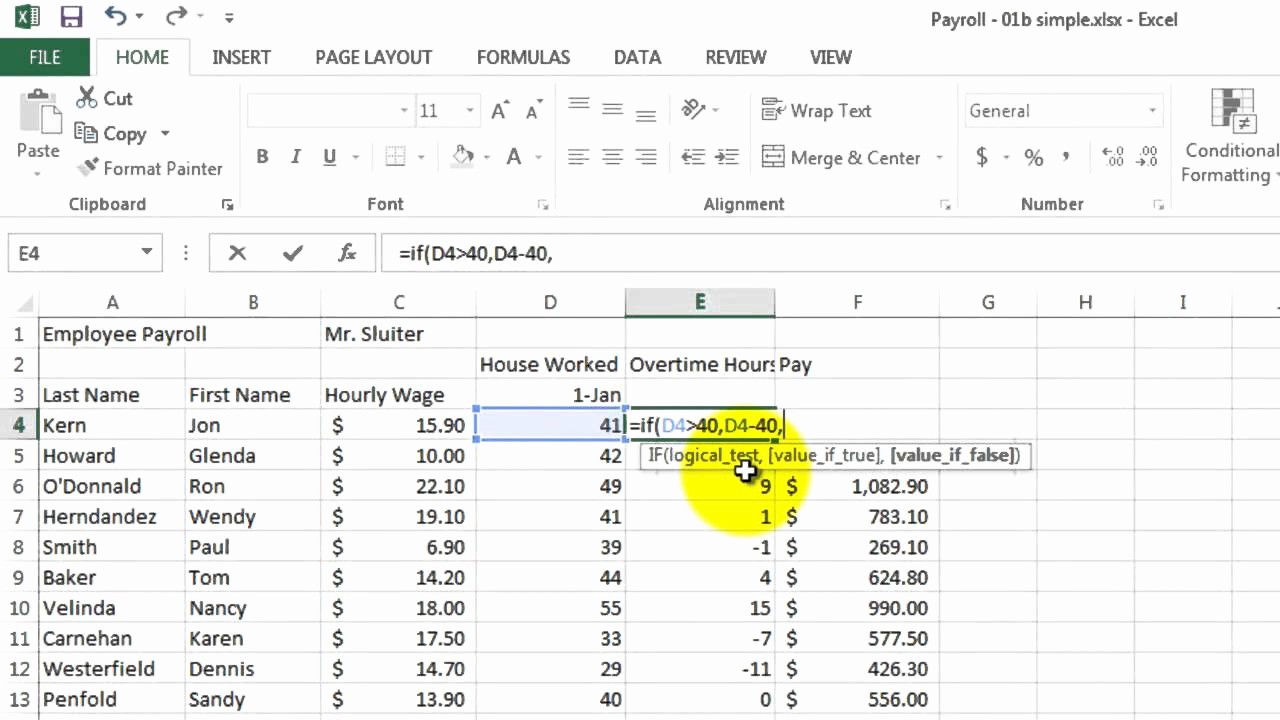

Payroll excel sheet with formula. Repeat this process for each employee in your payroll spreadsheet, and excel will automatically calculate the gross pay for each employee based on their hourly rate and number of hours worked. Home » calculation with excel formulas » payroll exercises in excel: The first step is to set up the spreadsheet.

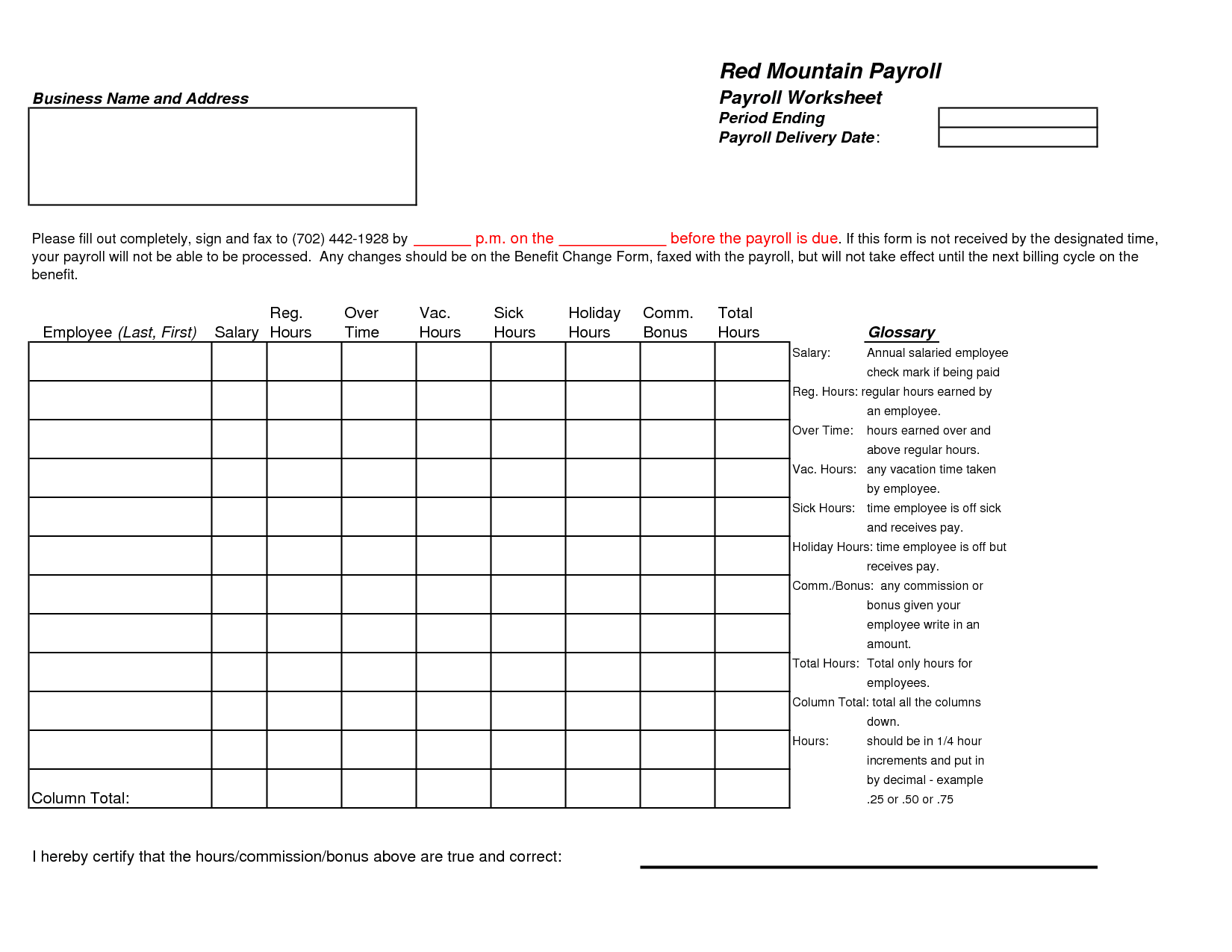

You can also add additional columns for overtime, bonuses, and other payments. Managing payroll can be a complex task, requiring accurate calculations and attention to detail. Formula to calculate salary.

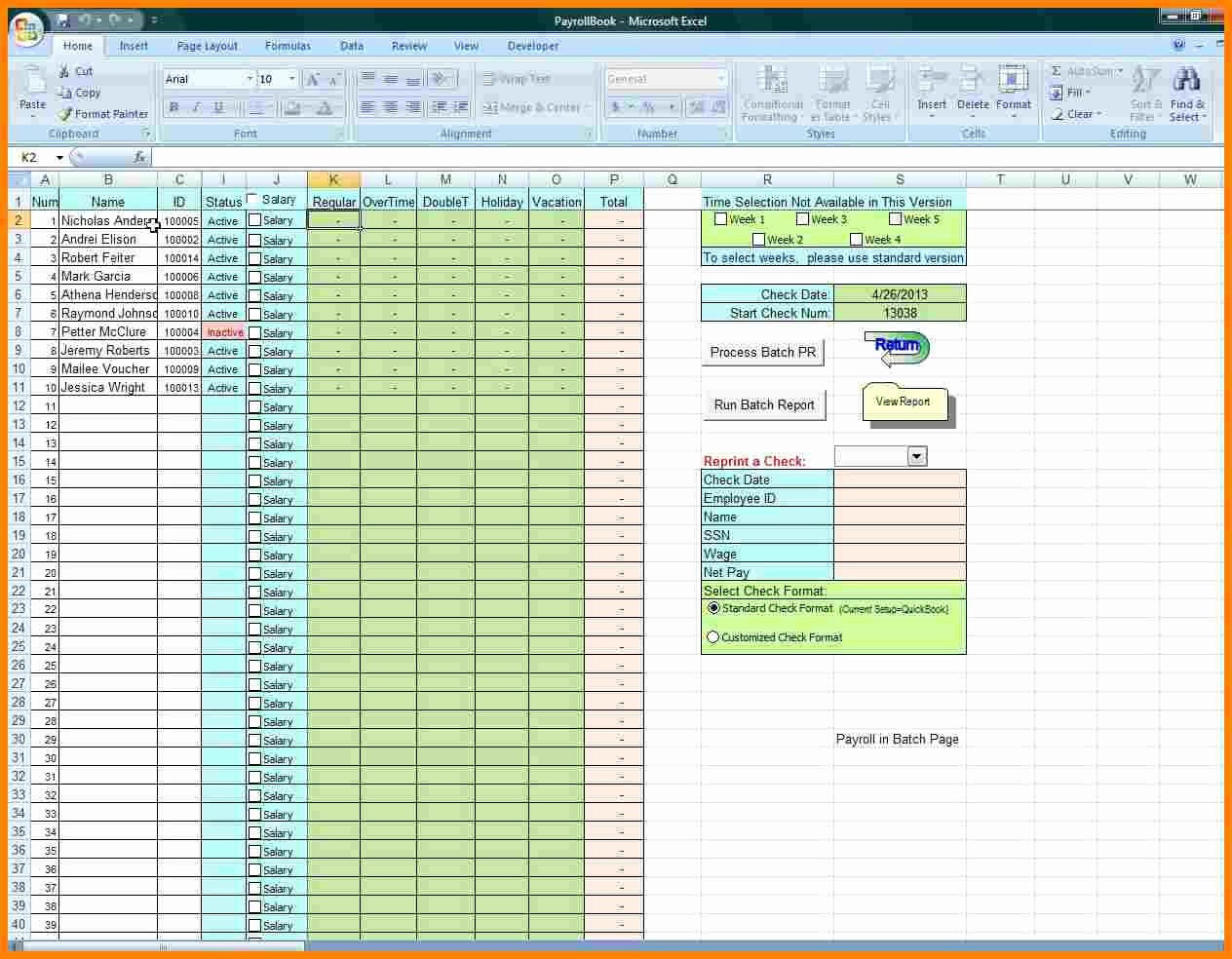

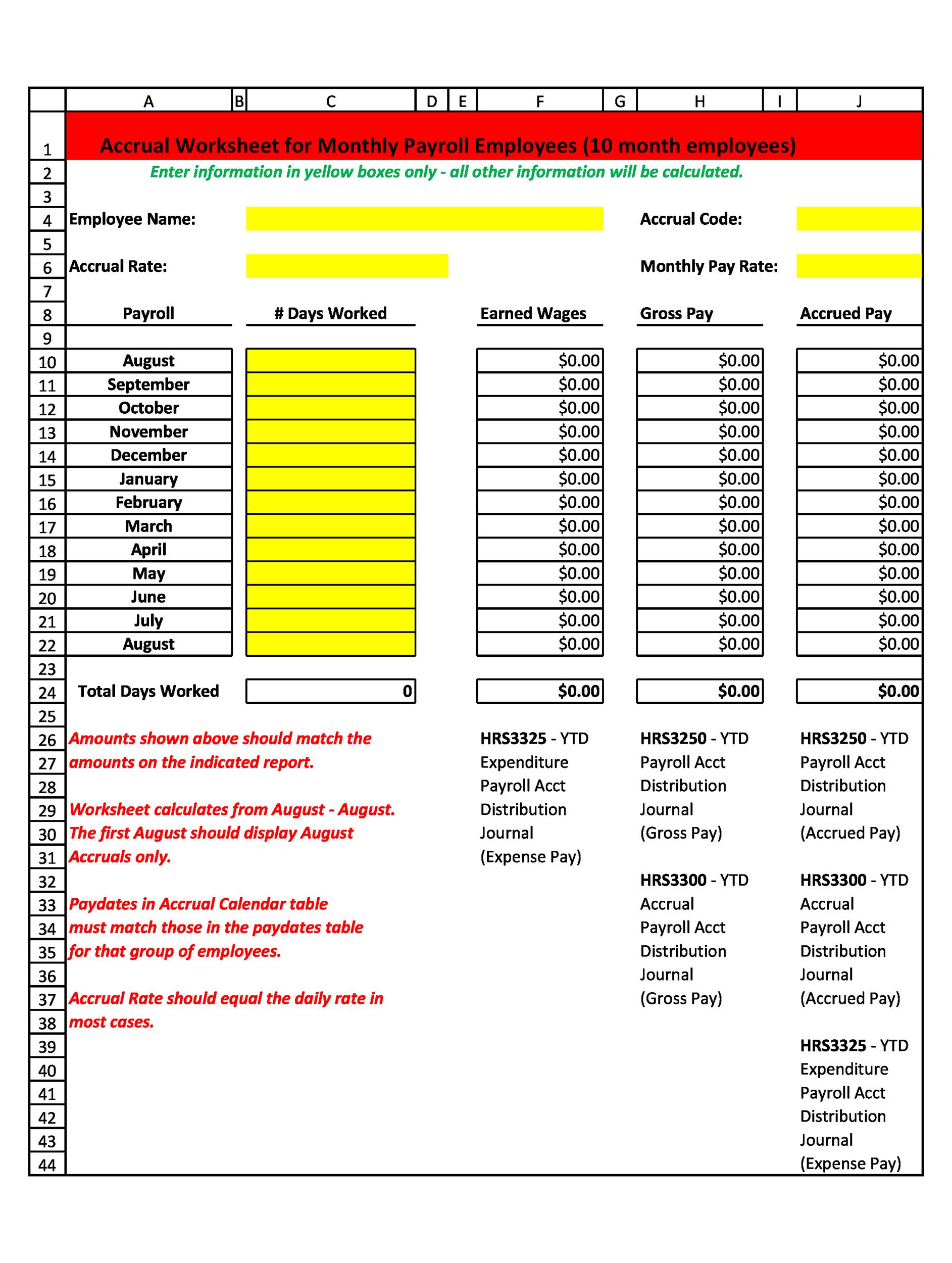

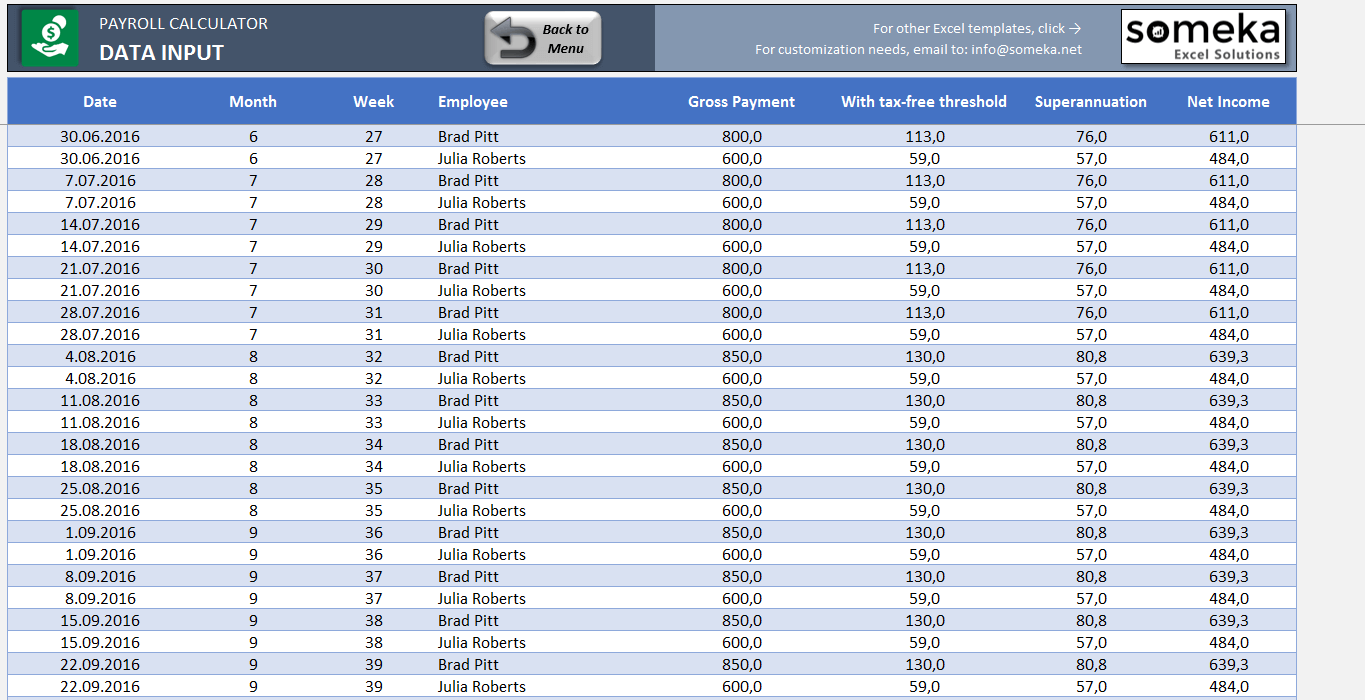

0:00 / 11:49. A payroll template is a tool that tracks and documents hourly rates and tax rates in each employee’s state and country. For the full article visit:.

1.4m views 9 years ago. Figuring out how to do payrollusing an excel template can take some time. Including deductions and calculating net pay.

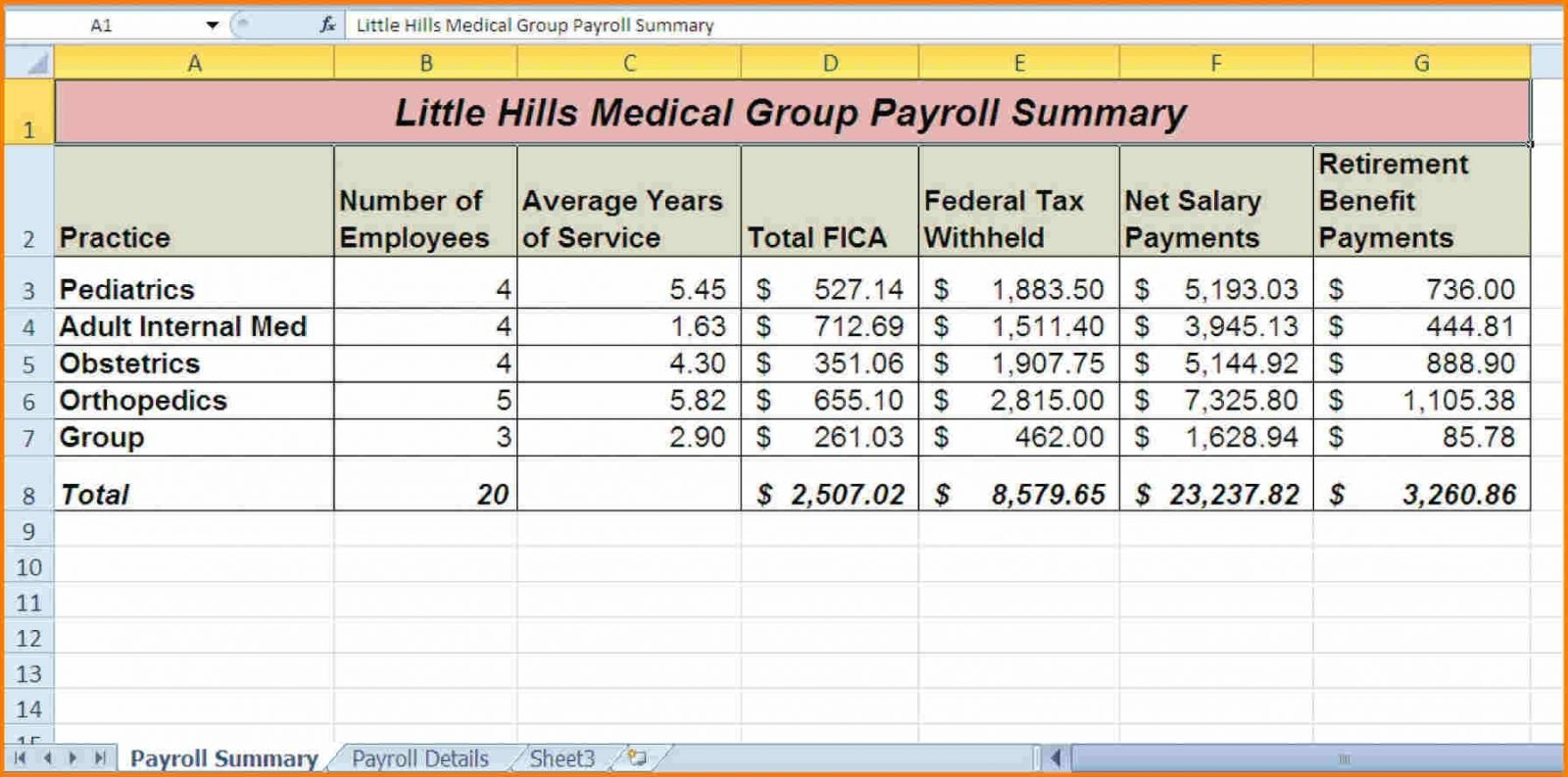

Excel lesson #2 use excel to create a payroll table for a business. First, you need to take a look at the template and evaluate your business needs. Open a new workbook in excel and create a table with the following columns:

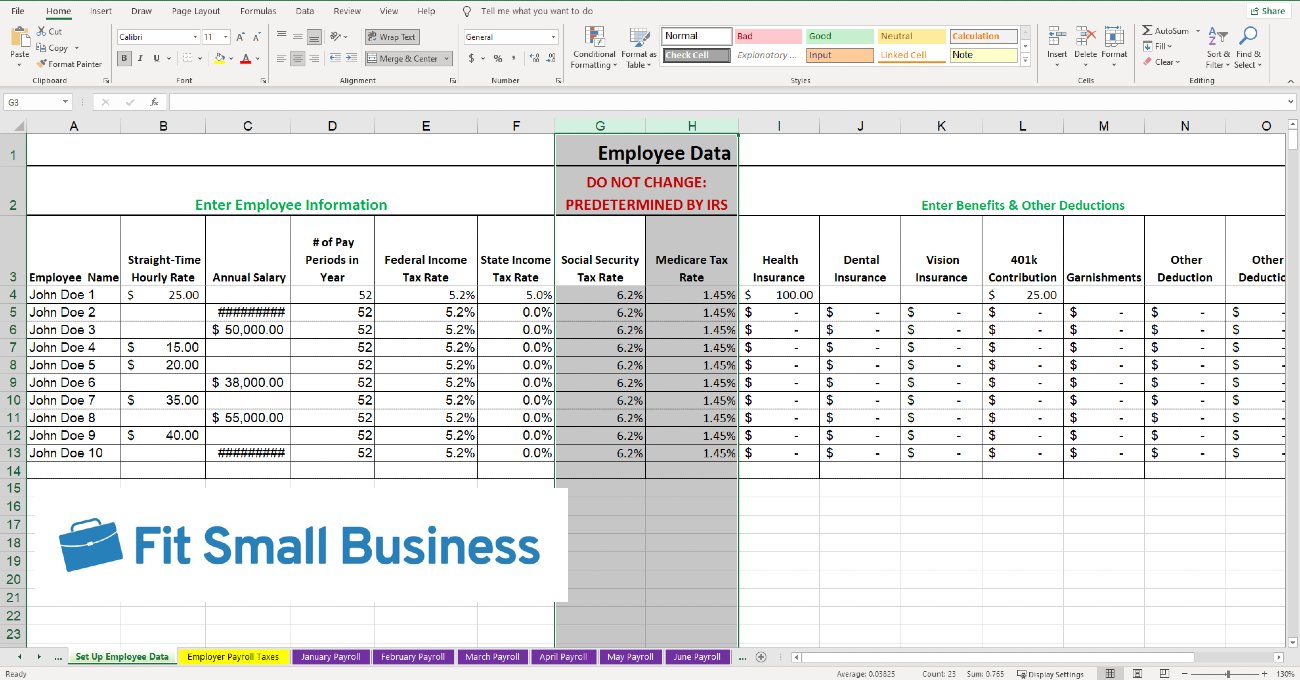

You also need a “set up”. Paste the following formula in any adjacent cell (i.e., e7 ). The payroll formula is used by employers to determine the net pay of an employee or worker after deducting various.

Methods to make payroll in excel? In this article, you will get five excel payroll exercises. What is payroll formula?

71k views 3 years ago payroll. Type “= [hourly rate] * [number of hours worked]”. It also accounts for deductions so you can pay your employees correctly.

Calculate sum of employer parameters. A payroll template is also referred to as salary sheet. Simple, easy, and fully automated payroll excel template with attendance predefined formulas and functions that help you process the payroll of 50 employees in just a few minutes.

Hit enter and drag the fill handle. A standardized template should have tabs for each month, with links to formulas that calculate employee taxes, deductions, and pay. Employee id, employee name, basic salary, allowances, deductions, and net salary.

![How to Do Payroll in Excel in 7 Steps [+ Free Template]](https://fitsmallbusiness.com/wp-content/uploads/2019/04/How-to-Do-Payroll-in-Excel_03.png)