Here’s A Quick Way To Solve A Info About Couple Expenses Spreadsheet

Create a budget together, give yourselves allowances, and have fun with your own personal stash of cash.

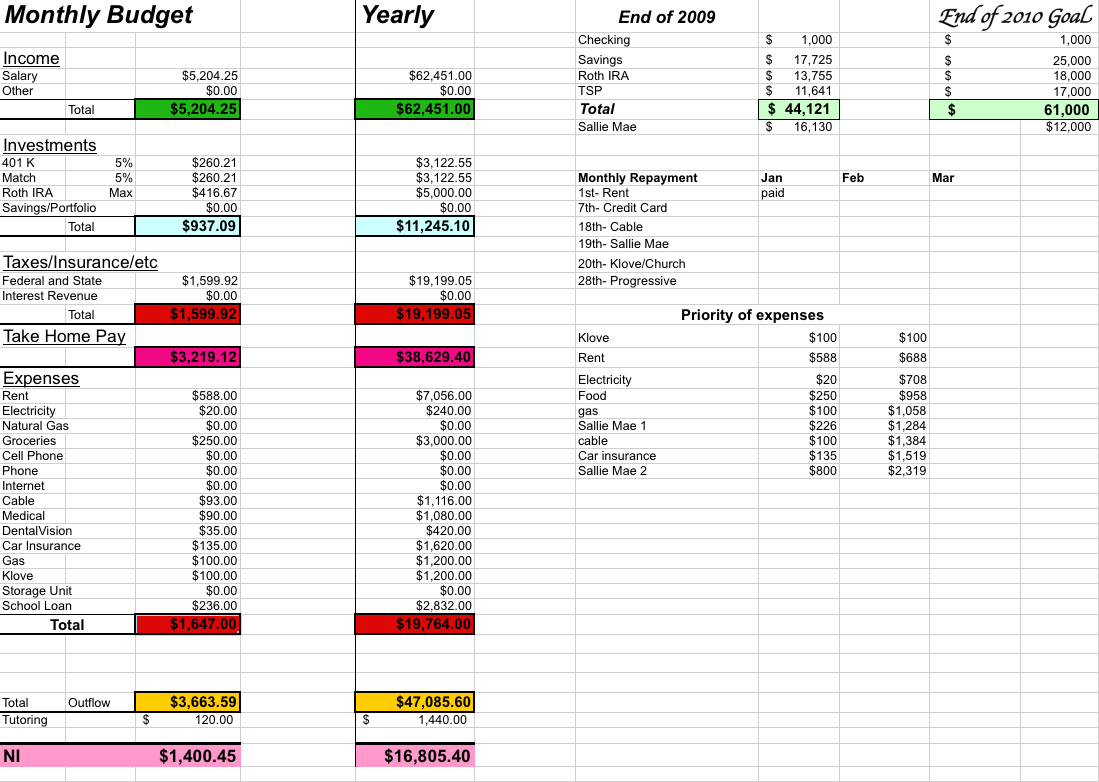

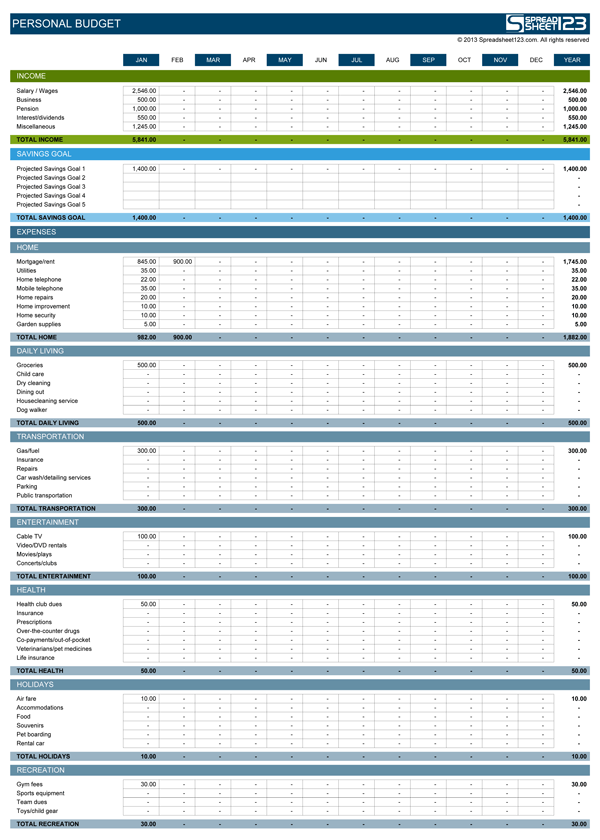

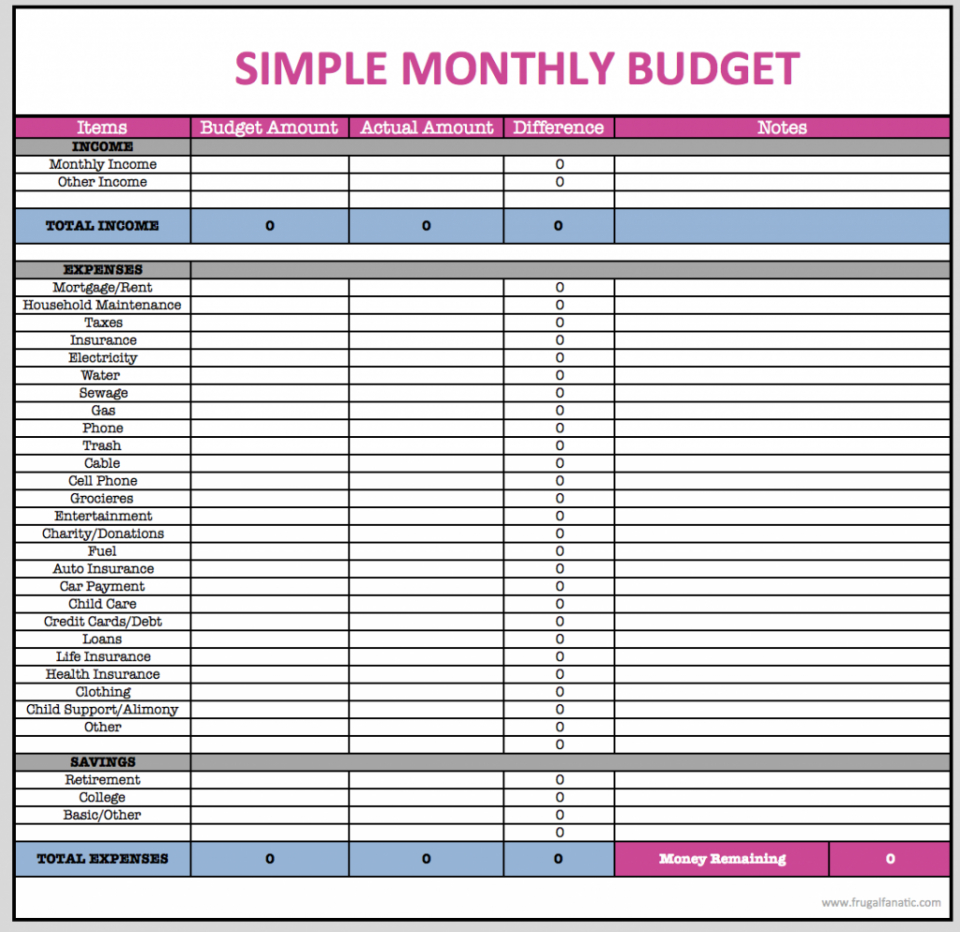

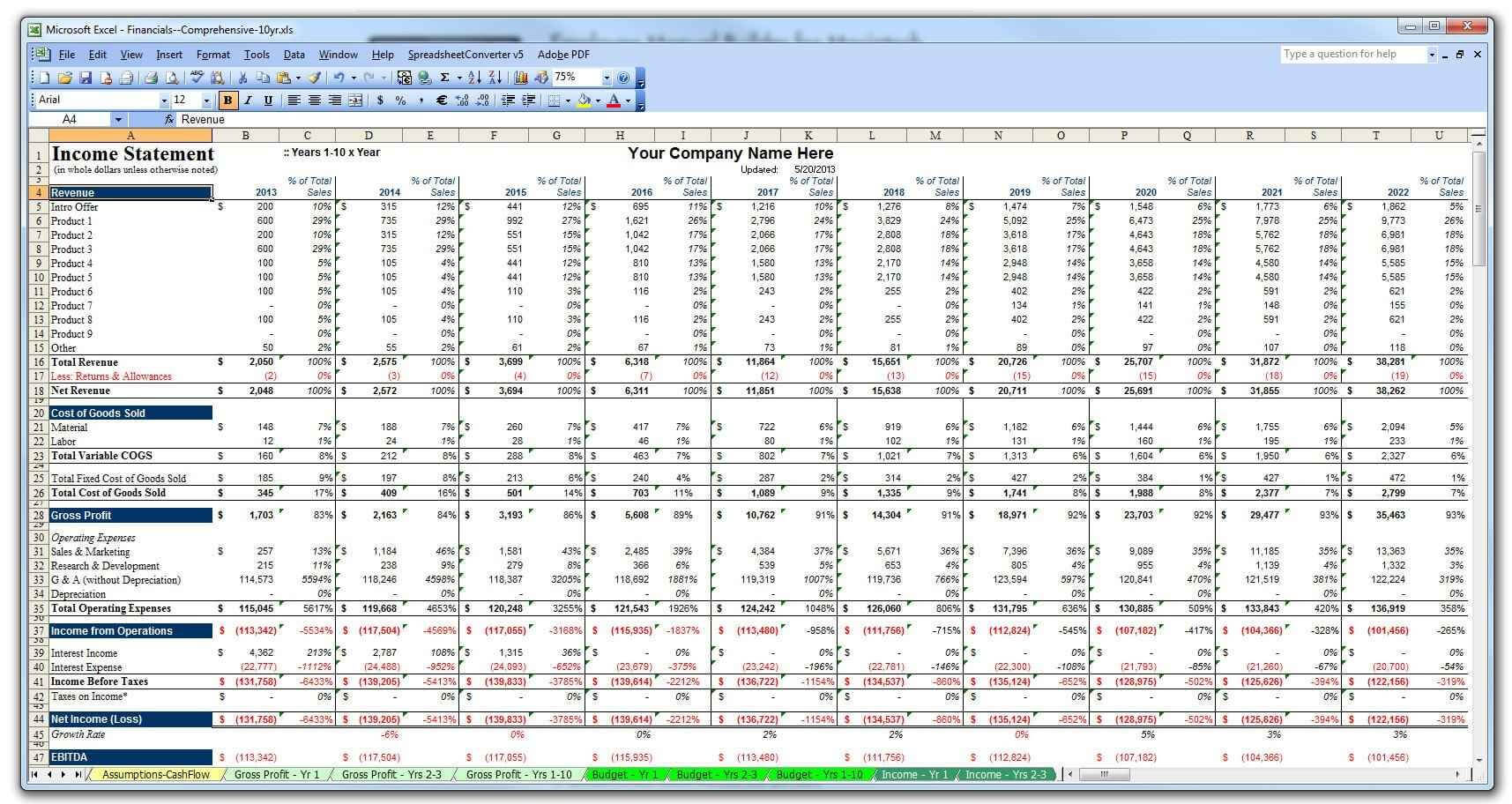

Couple expenses spreadsheet. The spreadsheet will automatically calculate your total monthly spend,. We included all of our main income and expense sources, but feel free to add your own. This calculator helps you work out where your money is going, and whether your income covers your expenses.

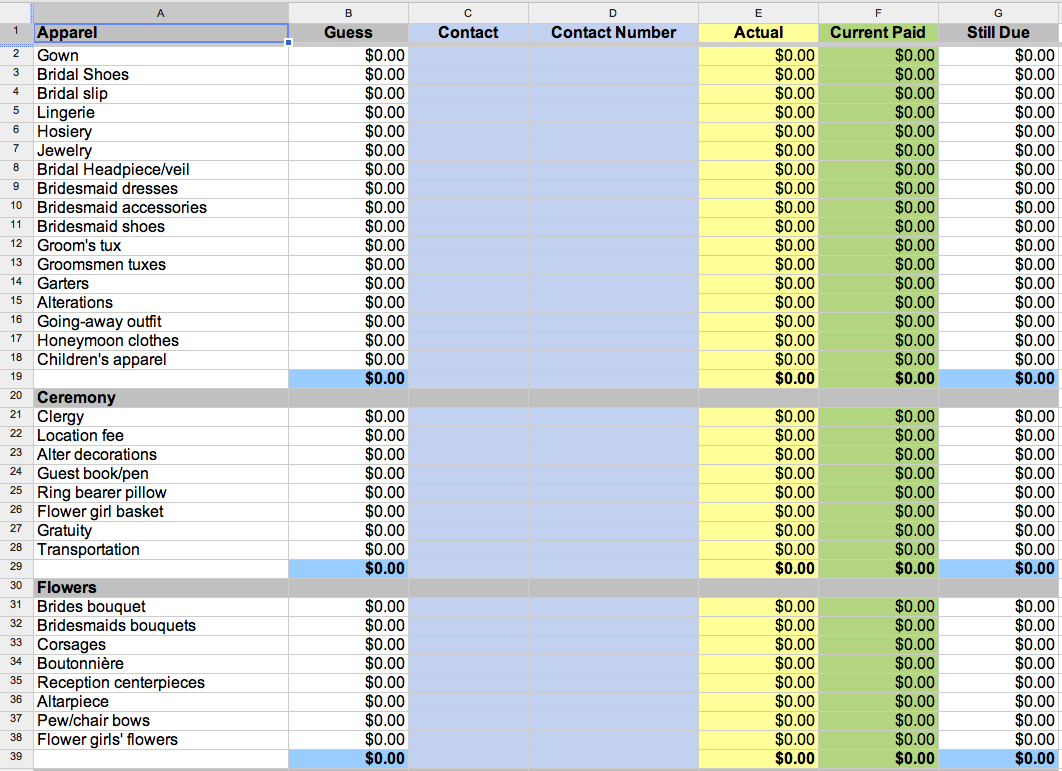

Here is a list of my other spreadsheets that. Whether you want to use an excel spreadsheet or. Input your costs and income, and any difference is calculated automatically so you can avoid.

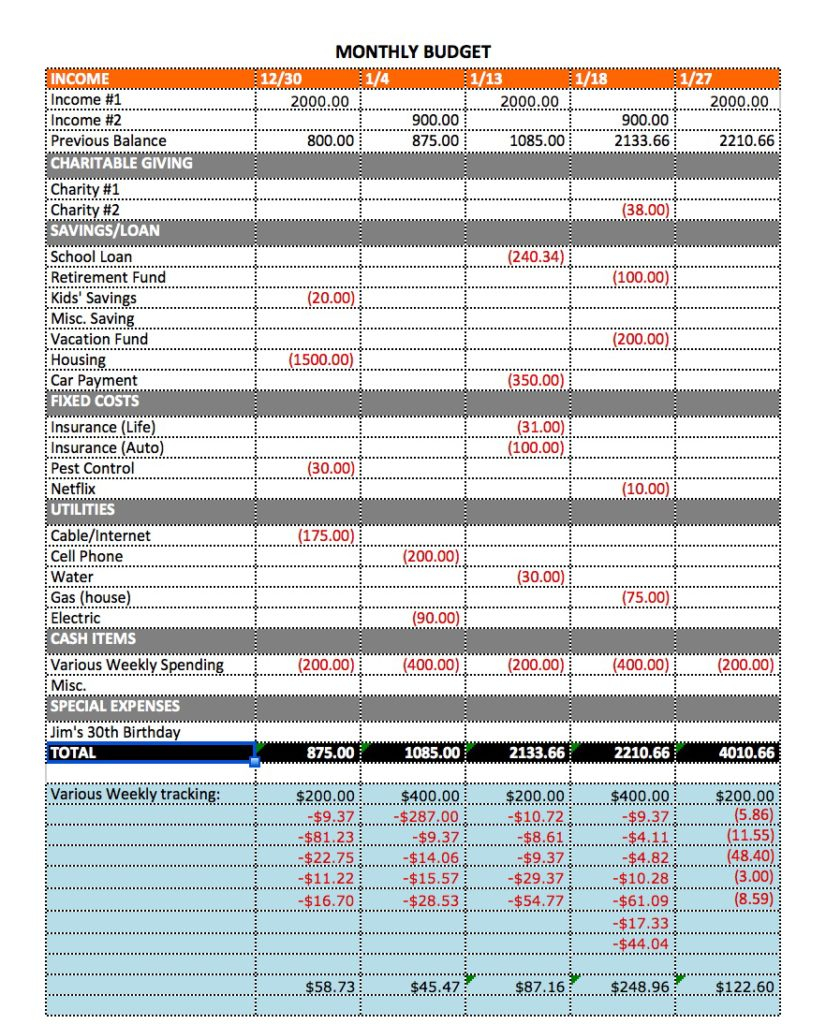

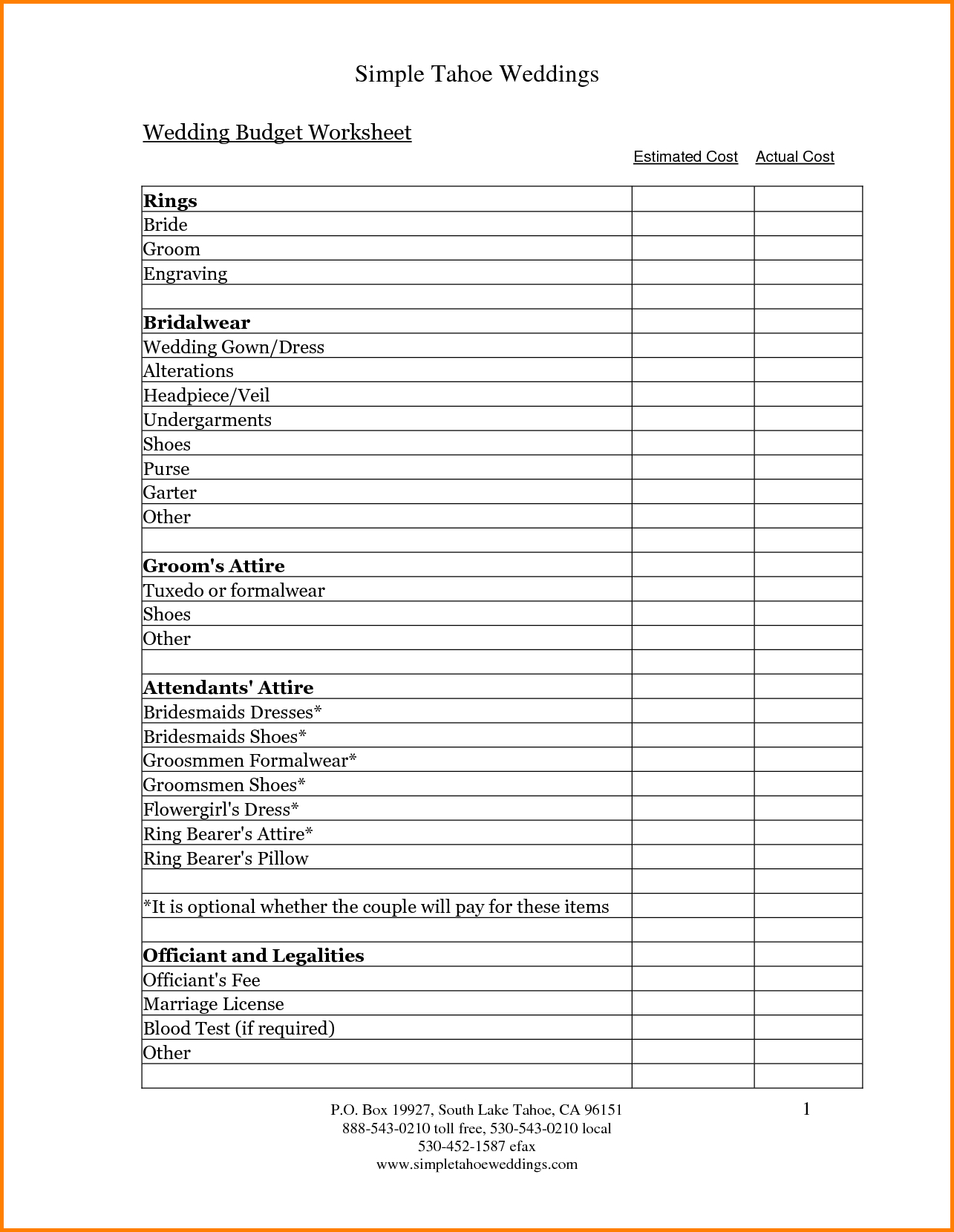

You record your desired budget for each. Set payment frequency for each item — weekly,. Smartsheet college student budget 6.

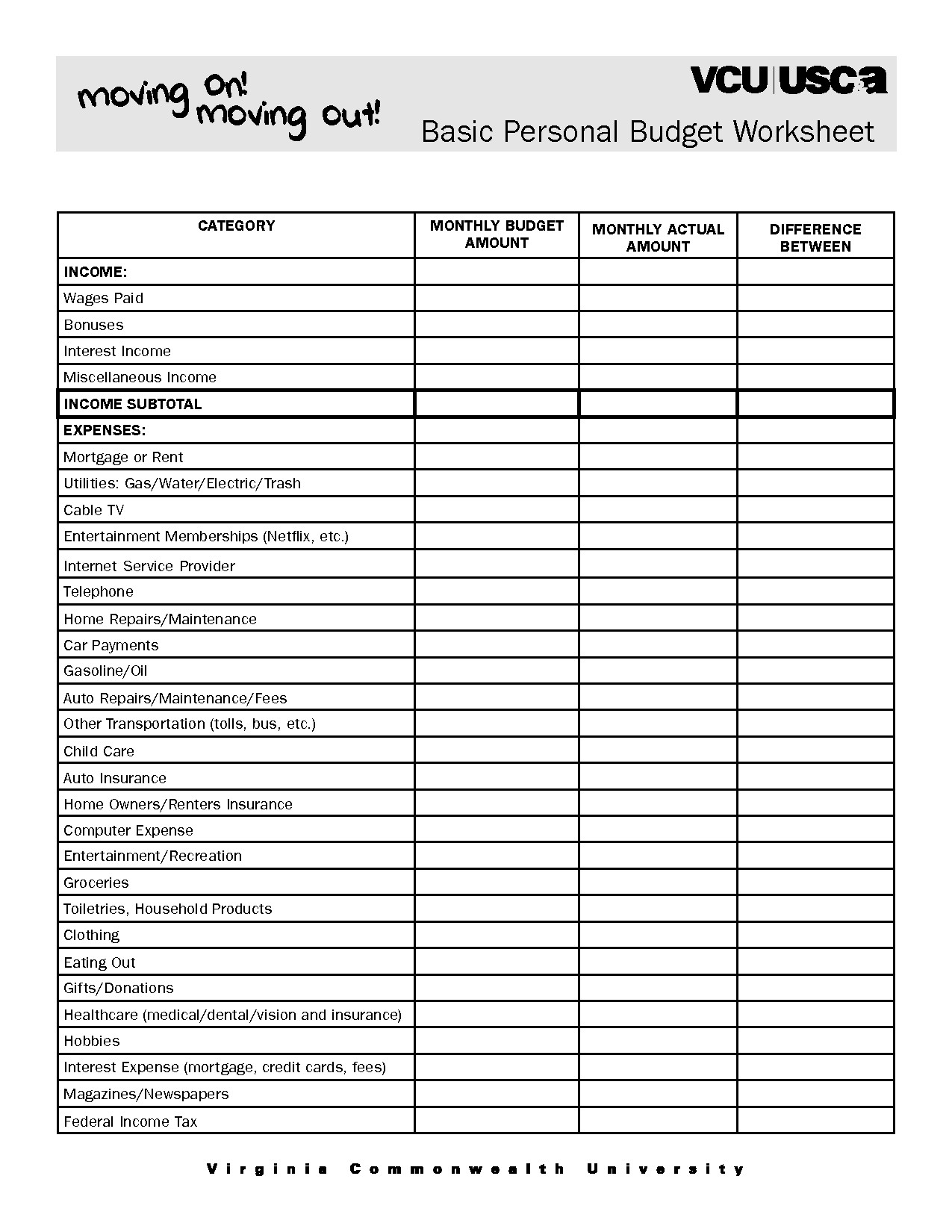

Tracking monthly expenses in a budget spreadsheet or template can make managing your money a little easier. There are both free and paid spreadsheets, and these are separated on the page so you can head straight to the free ones if that’s what you want. Lay the groundwork by compiling these financial records, as well as info on credit card debt, pension contributions and one.

Let your allowance money roll over. Budgeting as a couple is still doable with finance apps and budgeting tools. While that may seem like a high target, if.

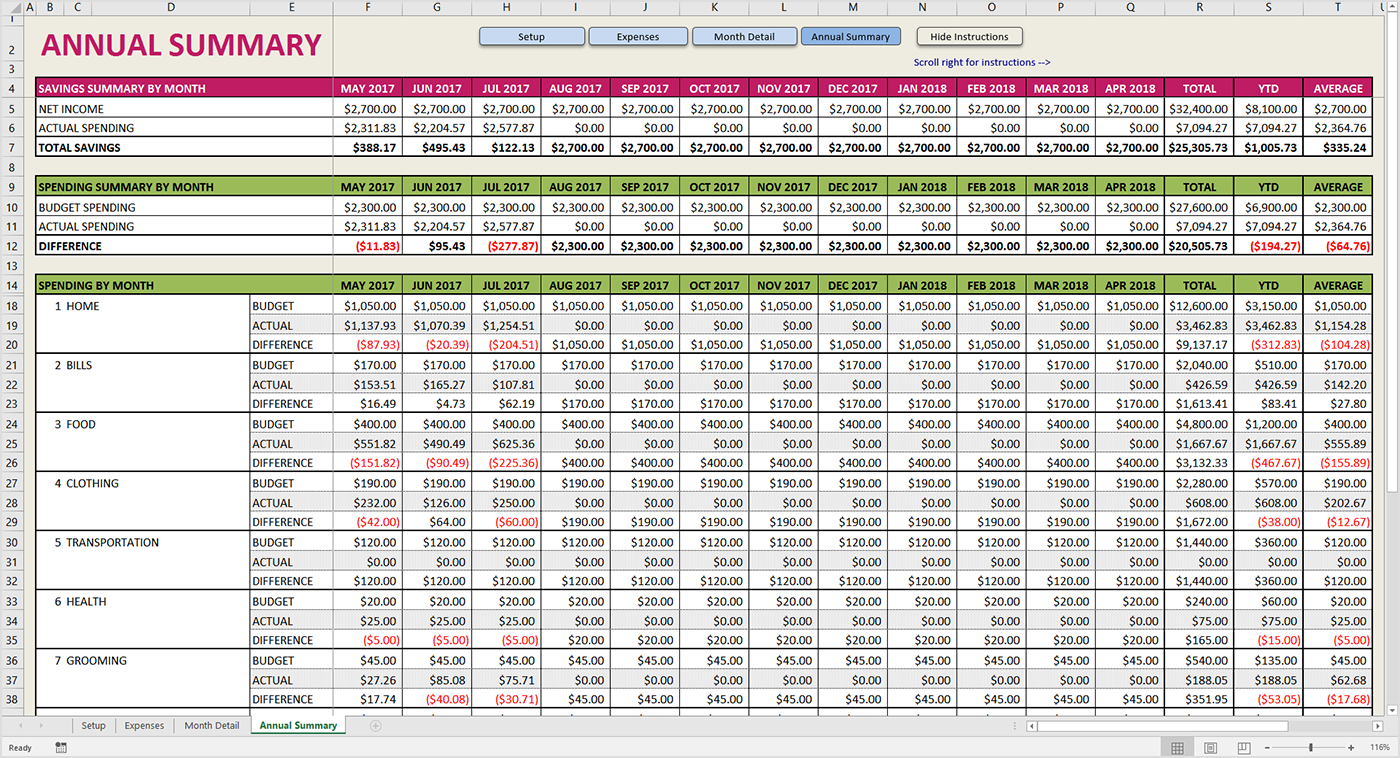

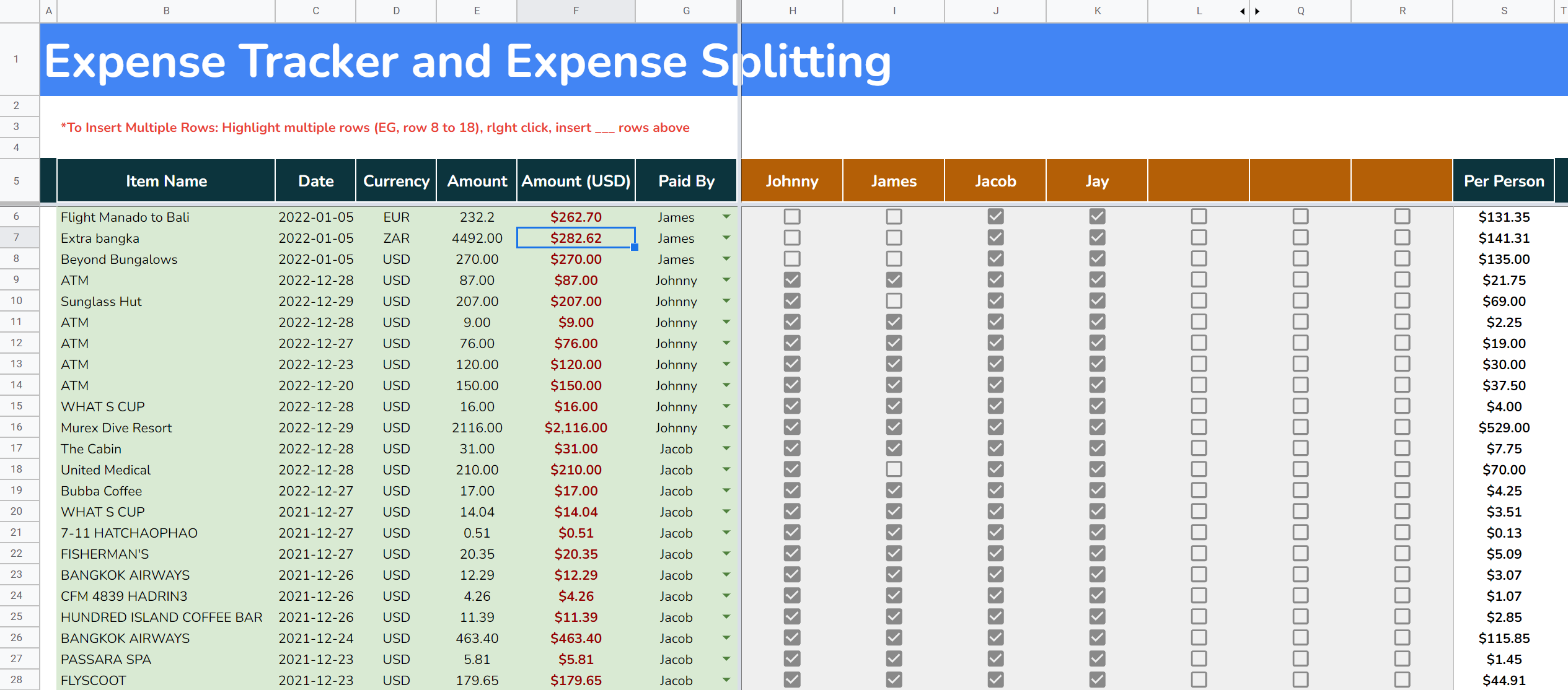

The purpose of this worksheet is to help you compare your monthly budget with your actual income and expenses. Couples don’t have to be married or even in a romantic relationship to open a joint bank account or build a joint spreadsheet that tracks each other’s expenses. This shared expenses spreadsheet template is designed to help you keep track of split costs among friends, family, or roommates.

Google sheets budget trackers 4. The simple, short and sweet answer is to know your income and your joint basic expenses, and you’re more than halfway there. Leverage budgeting tools.

Apps allow you to track your income and expenses, update. This free simple budget template. They have a spreadsheet for their joint accounts (one for household bills and one for groceries), which they use to budget their monthly expenses.