Exemplary Info About Excel Tax Deduction Template

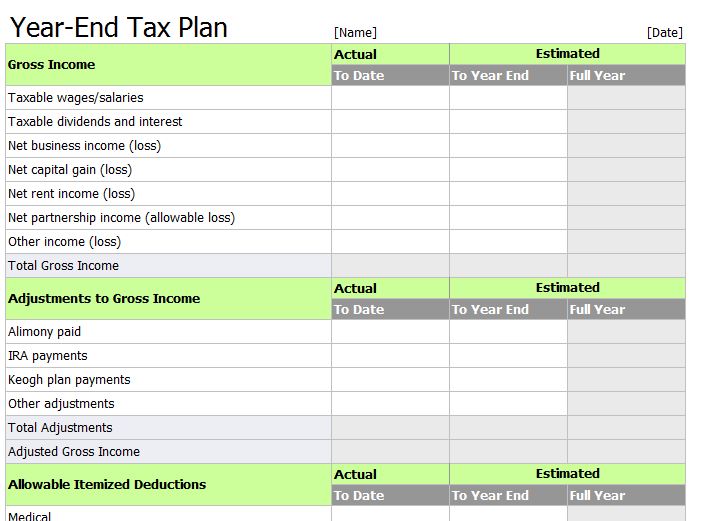

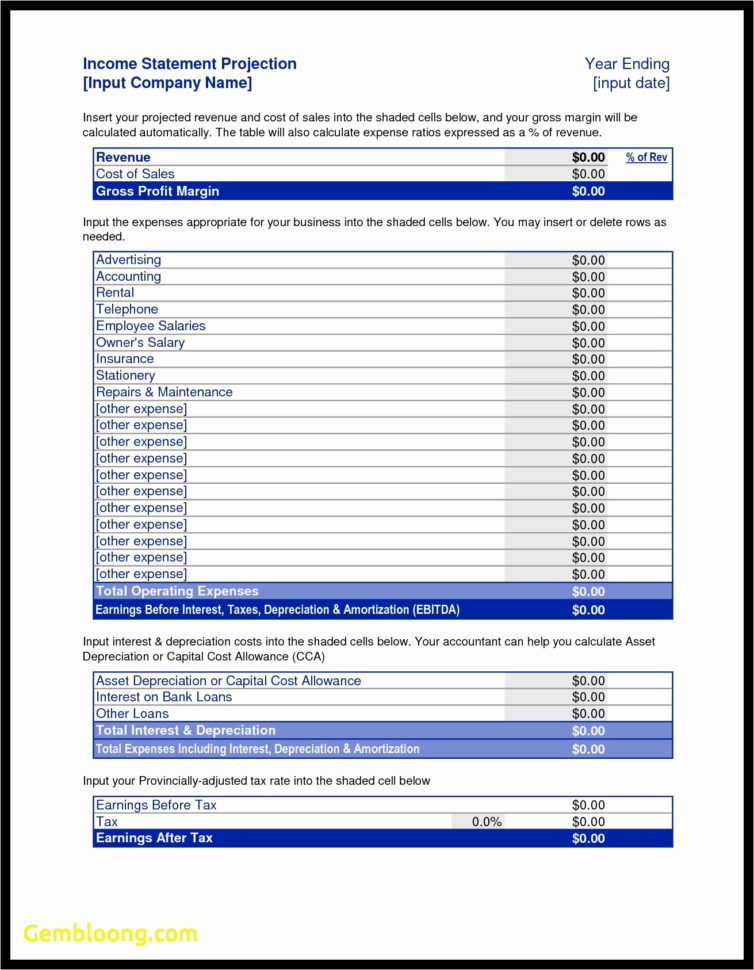

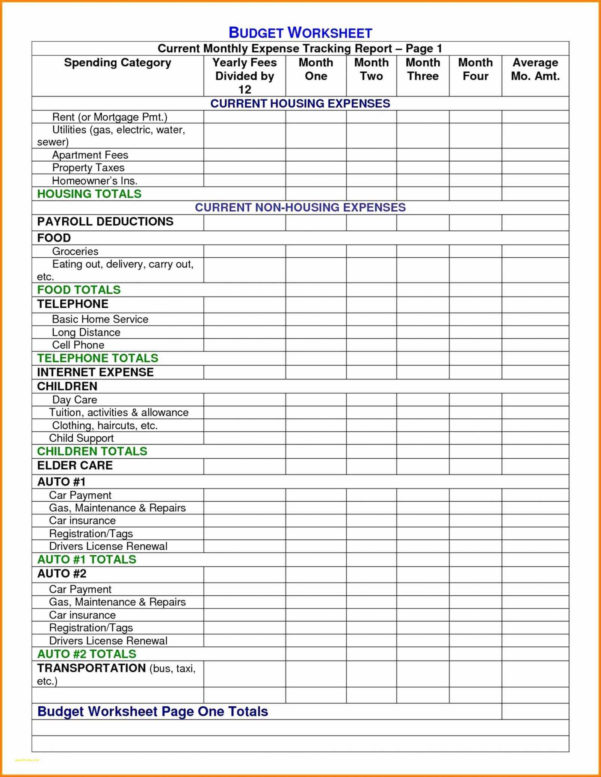

This free excel template helps the taxpayer to choose between standard and itemized deductions.

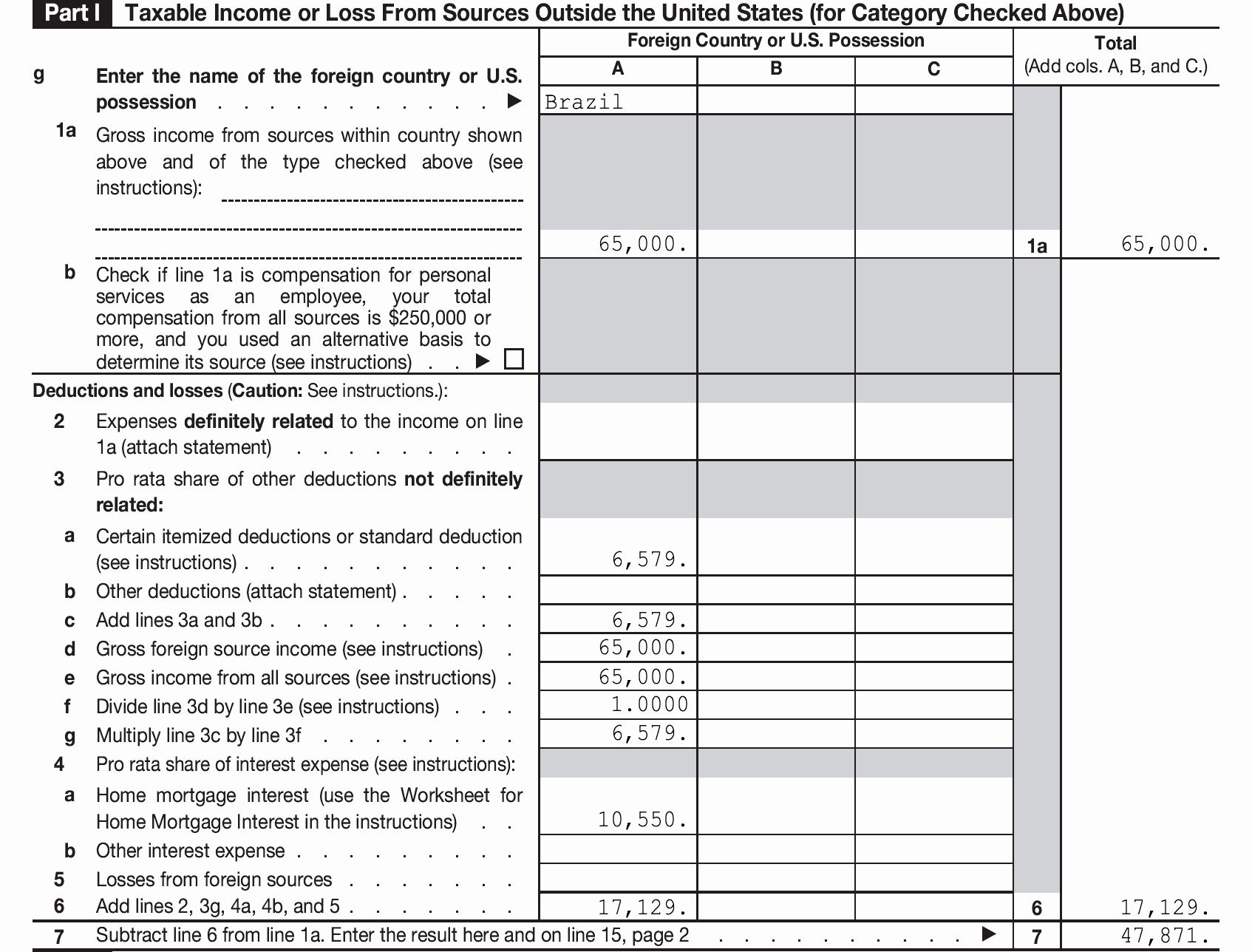

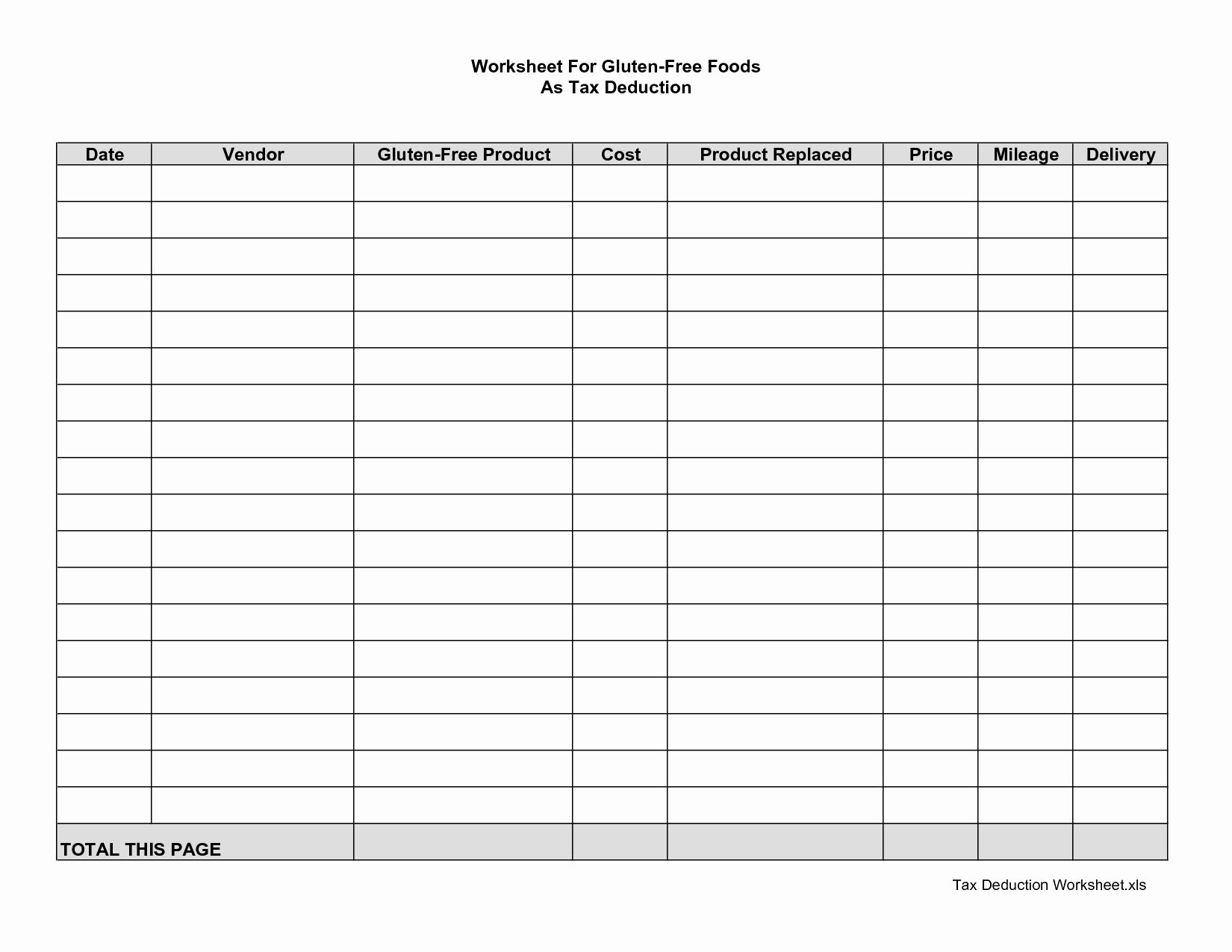

Excel tax deduction template. Download itemized deductions calculator excel template. The checklist for tax deductions is the best template when it comes to filing your itemized tax deduction this year. It also helps the taxpayer to choose between standard and itemized deductions.

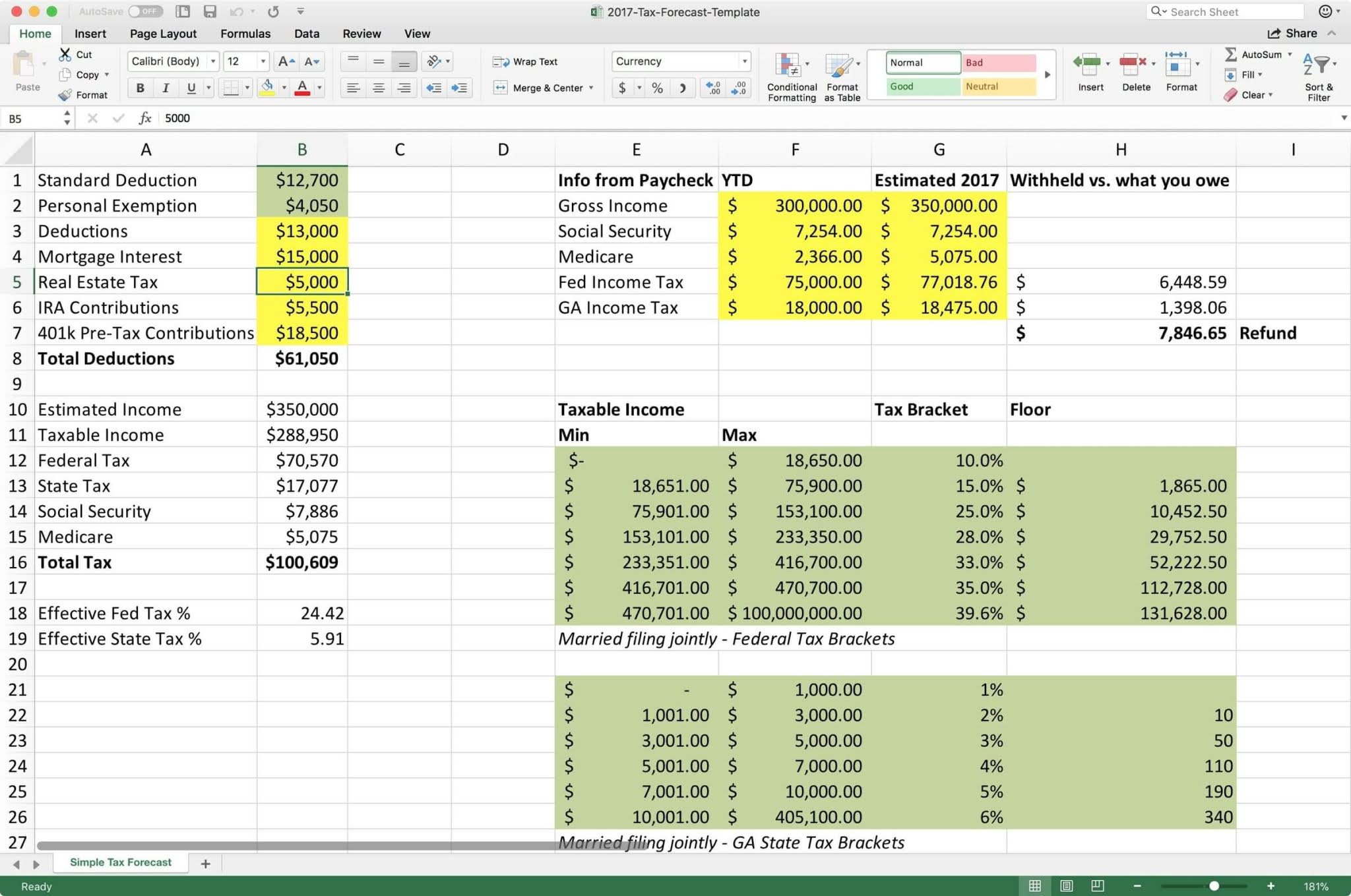

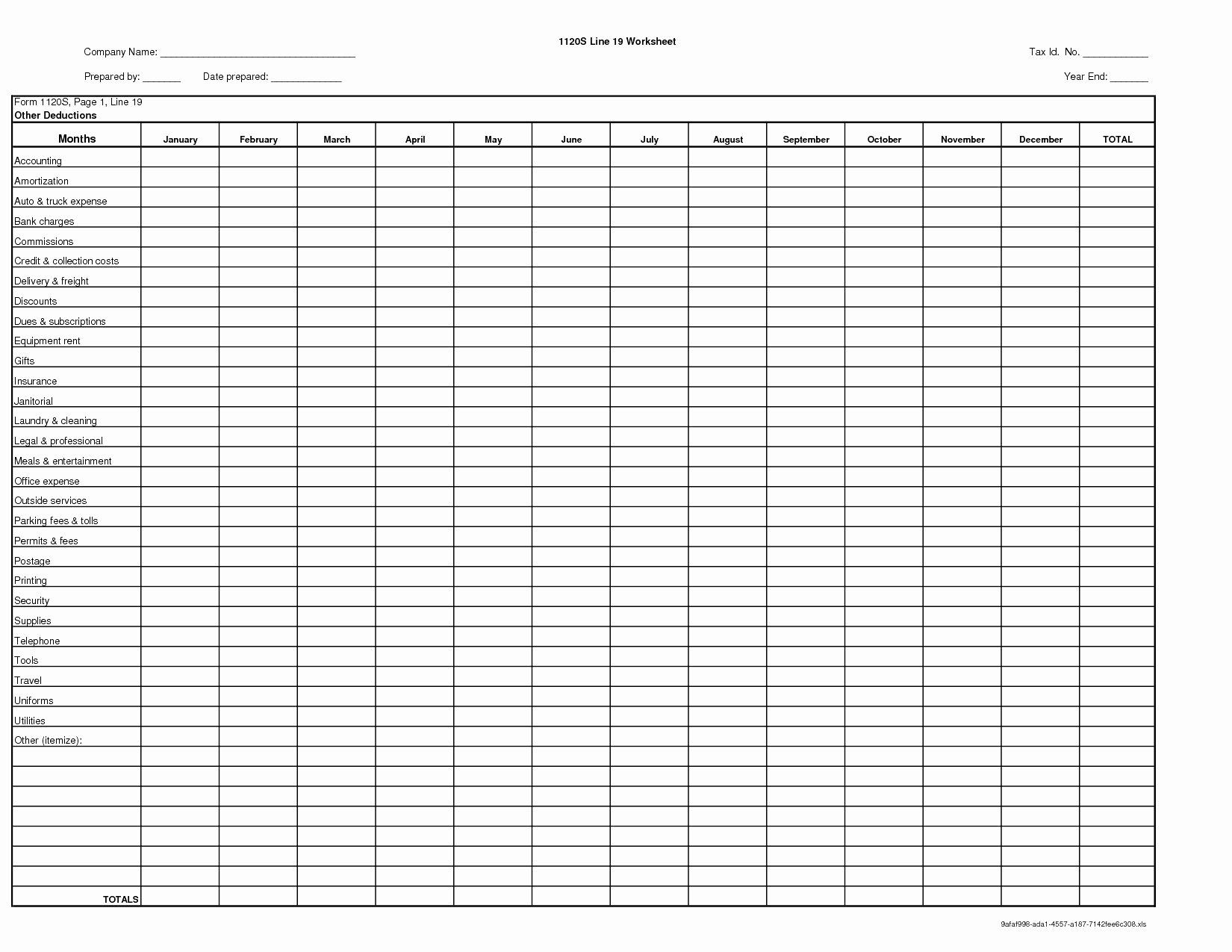

Tax calculator creator glenn reeves has been updating and distributing his custom excel template for. Perform a computation of income tax in excel based on multiple tax brackets (also referred to as a sliding income tax scale). The basic syntax of the.

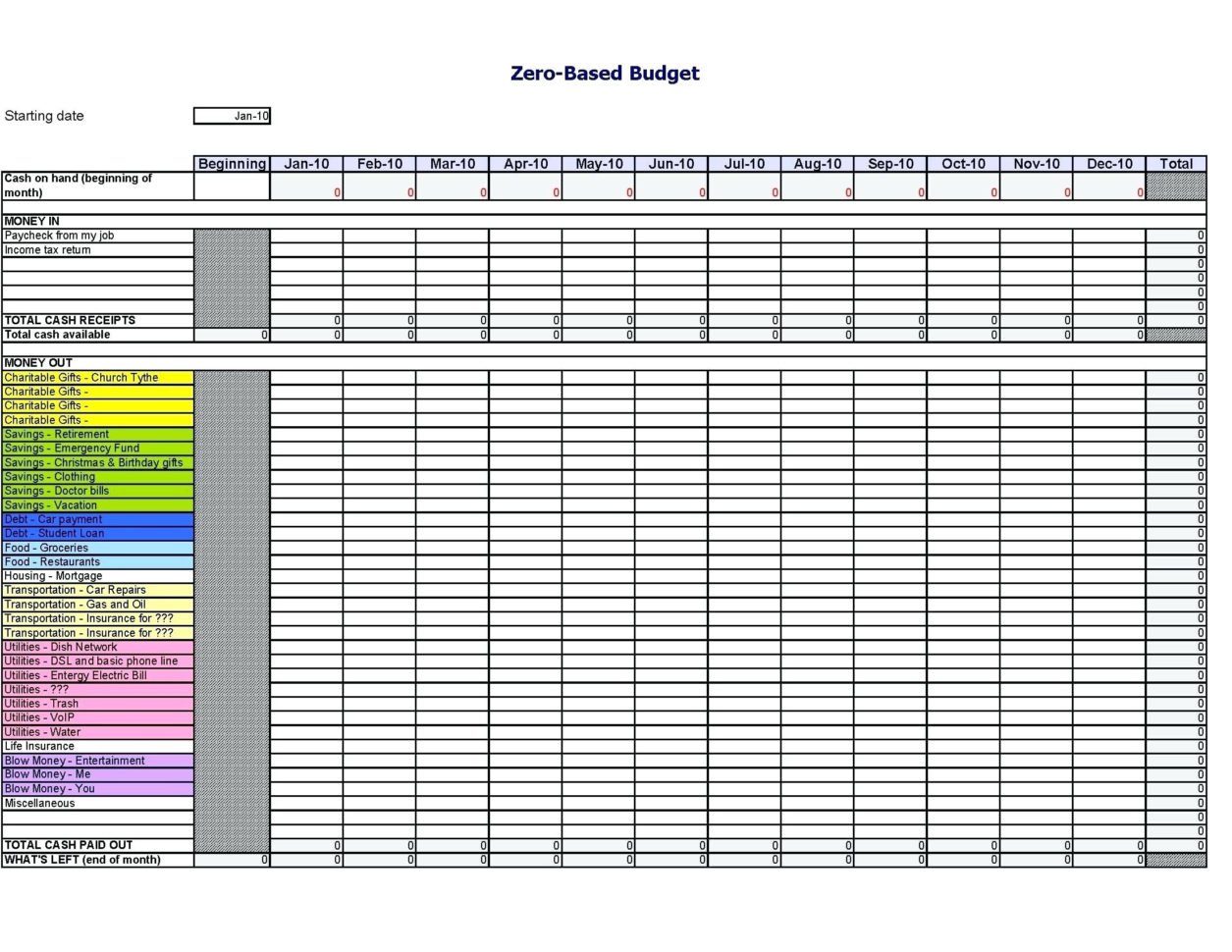

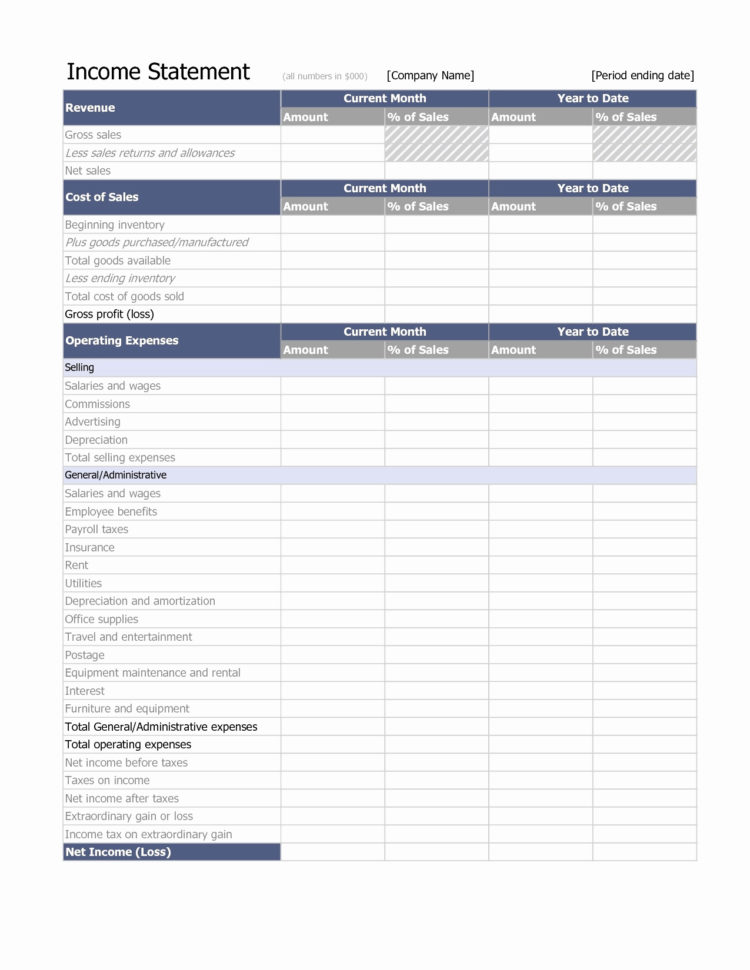

How do small business tax deductions work? Itemized deductions calculator is an excel template. The tabs in the tax tracker can be filled out in any.

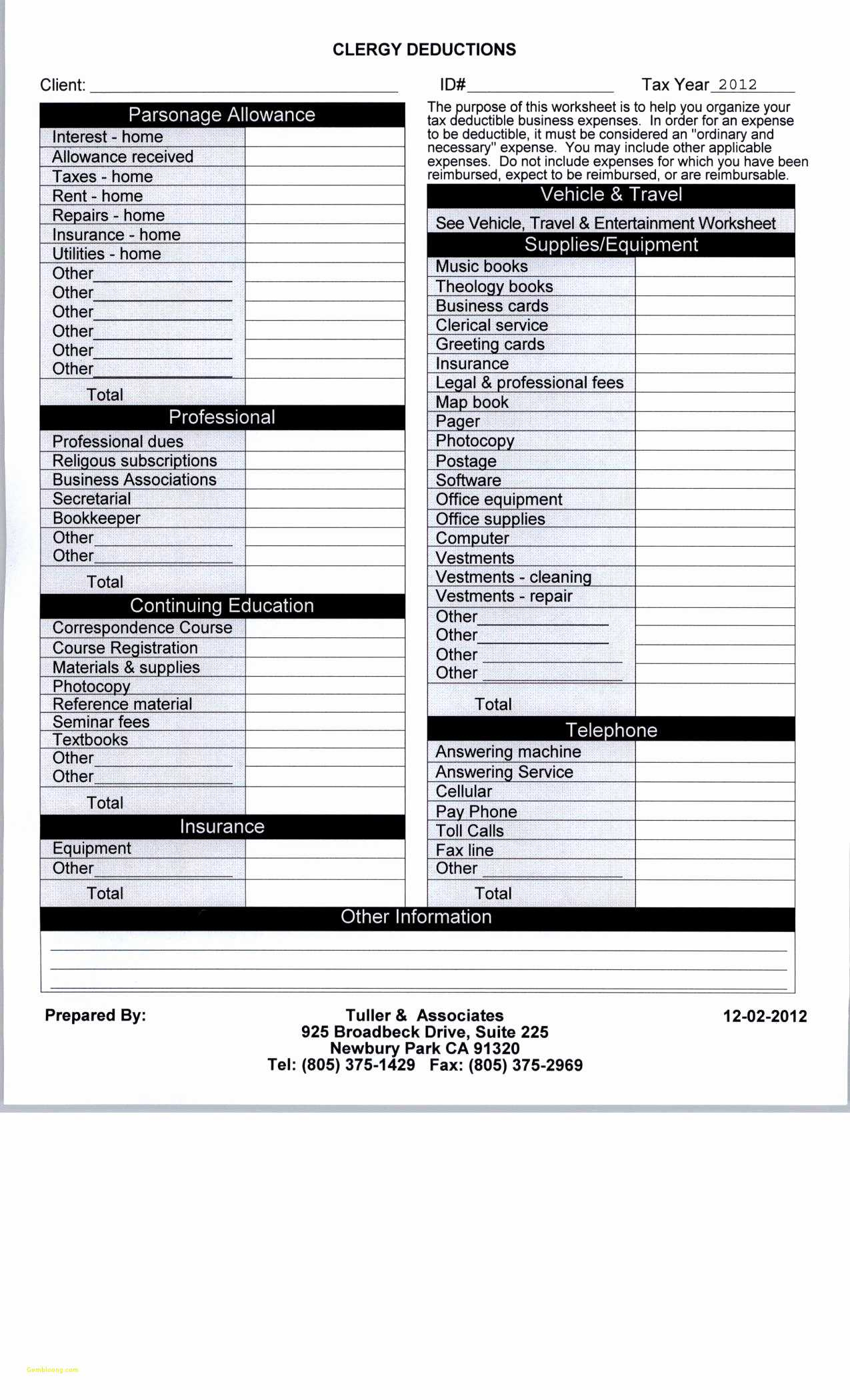

Like a result, will maximum deduction amount is $15,000. The resources below provide expert advice on tricky tax topics. The tax tracker template provides three major tools that alleviate the typical pain points with the 1040 schedules a, c, & d.

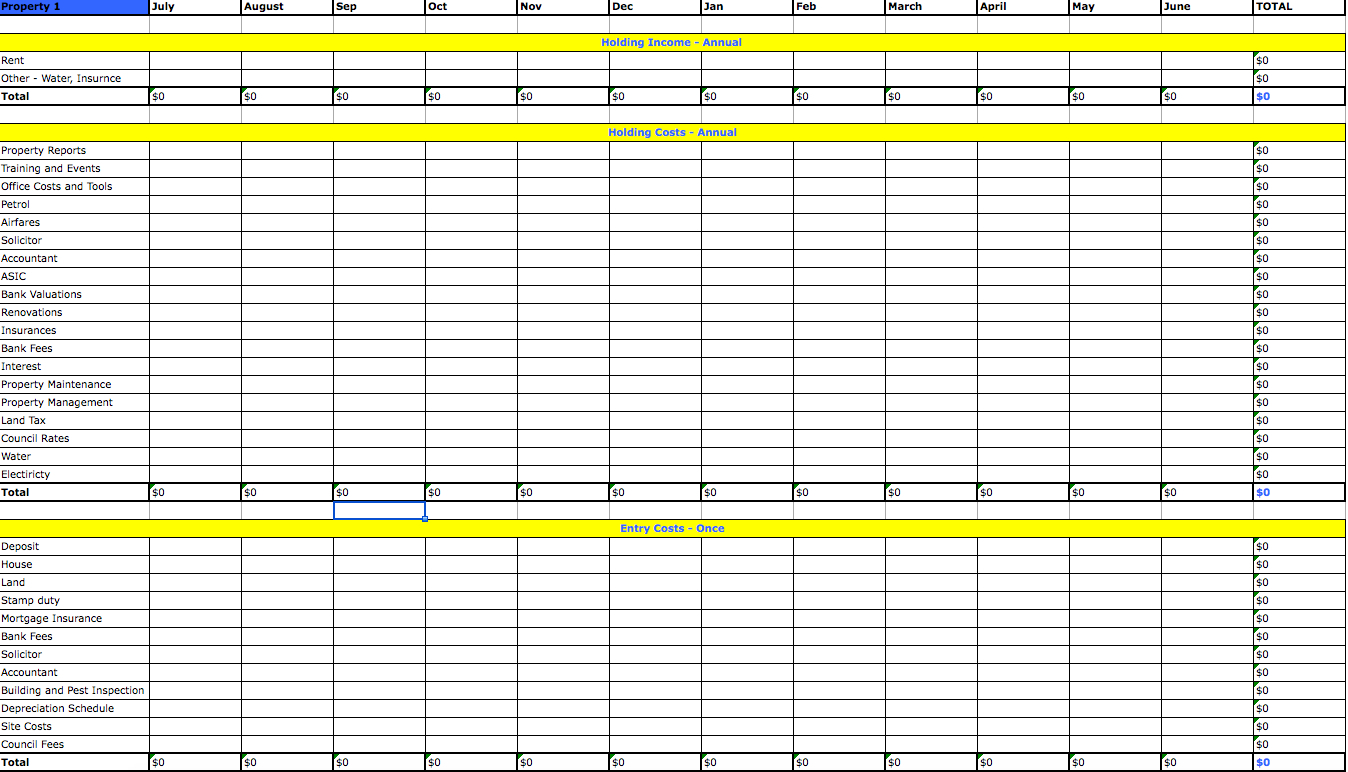

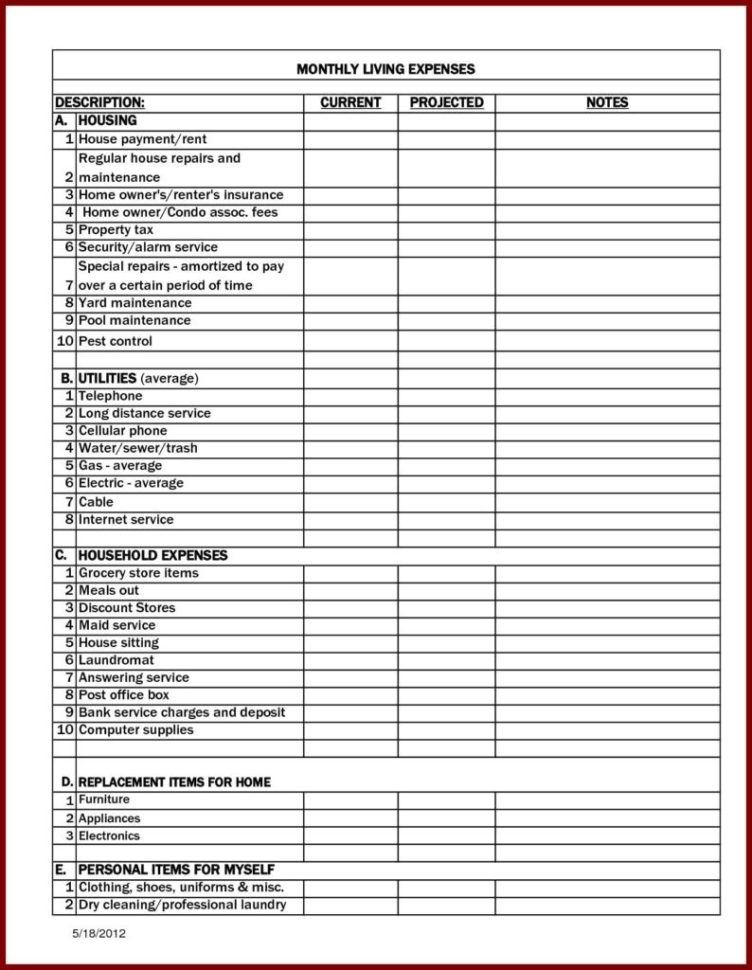

The worksheet is split up into three parts: The simple template was designed to give the freedom to enter. What is a tax deduction?

We built this worksheet in google docs, so you can use it anywhere you want, for free: It helps the taxpayer to choose between standard and itemized. All you need is an internet connection.

First, you must use a portion of your home. 26 income tax calculations template. Itemized deduction calculator is an excel template.

The are two requirements to qualify for a home office deduction. And maximum square footage you can use is 300 settle feet. But if you'd like to download your copy and use it in excel, you can do that too.

Financial income tax bracket calculation related functions summary to calculate total income tax based on multiple tax brackets, you can use vlookup and a rate table. As you navigate the 2024 tax season, use our cheat sheet to help you find all the answers you need. 55 small business tax deductions 4.

Do you qualify for the home office deduction? Who should you consult to confirm what you can.